Best Freelance Invoice Software: The Complete Guide to Getting Paid Faster

Find the best freelance invoice software for your business. Compare top tools, learn payment terms and late payment strategies.

Finding the best freelance invoice software can transform how you run your business. You finished a project at 2 AM, delivered everything the client requested, and now comes the part nobody taught you in design school, coding bootcamp, or writing workshops: getting paid. The creative work was the easy part. The business side—freelance invoicing, payment terms, chasing late payments—that is where most freelancers struggle.

Here is the truth about freelancing: your invoice is not just a request for money. It is a legal document, a reflection of your professionalism, and often the final impression you leave on a client. A disorganized invoice invites delayed payments. A professional one communicates that you run a serious business and expect to be treated accordingly.

This guide covers everything freelancers need to know about invoicing: when to invoice, how to number invoices, what freelancer payment terms actually work for creative projects, how to handle deposits and kill fees, what to do when clients pay late, how to work with international clients, and how to choose the best freelance invoice software for your workflow. By the end, you will have a complete system for getting paid faster and with less stress.

Why Freelance Invoicing Requires a Different Approach

Freelancing is not like traditional employment or even like running a typical service business. Your invoicing challenges are unique:

Project-based relationships. You might work with a client once or for years. Your invoicing needs to flex between one-off projects and ongoing relationships.

Creative scope that evolves. Unlike installing an HVAC unit, creative work often changes direction mid-project. Revisions, pivots, and “just one more thing” requests are constant. Document project changes using a statement of work to protect yourself from scope creep.

Variable income timing. Some months you invoice $20,000. Others, $2,000. Your invoicing system needs to support cash flow management.

Client size diversity. Today you invoice a Fortune 500 company with 60-day payment terms and procurement requirements. Tomorrow, a solopreneur who pays via PayPal in ten minutes.

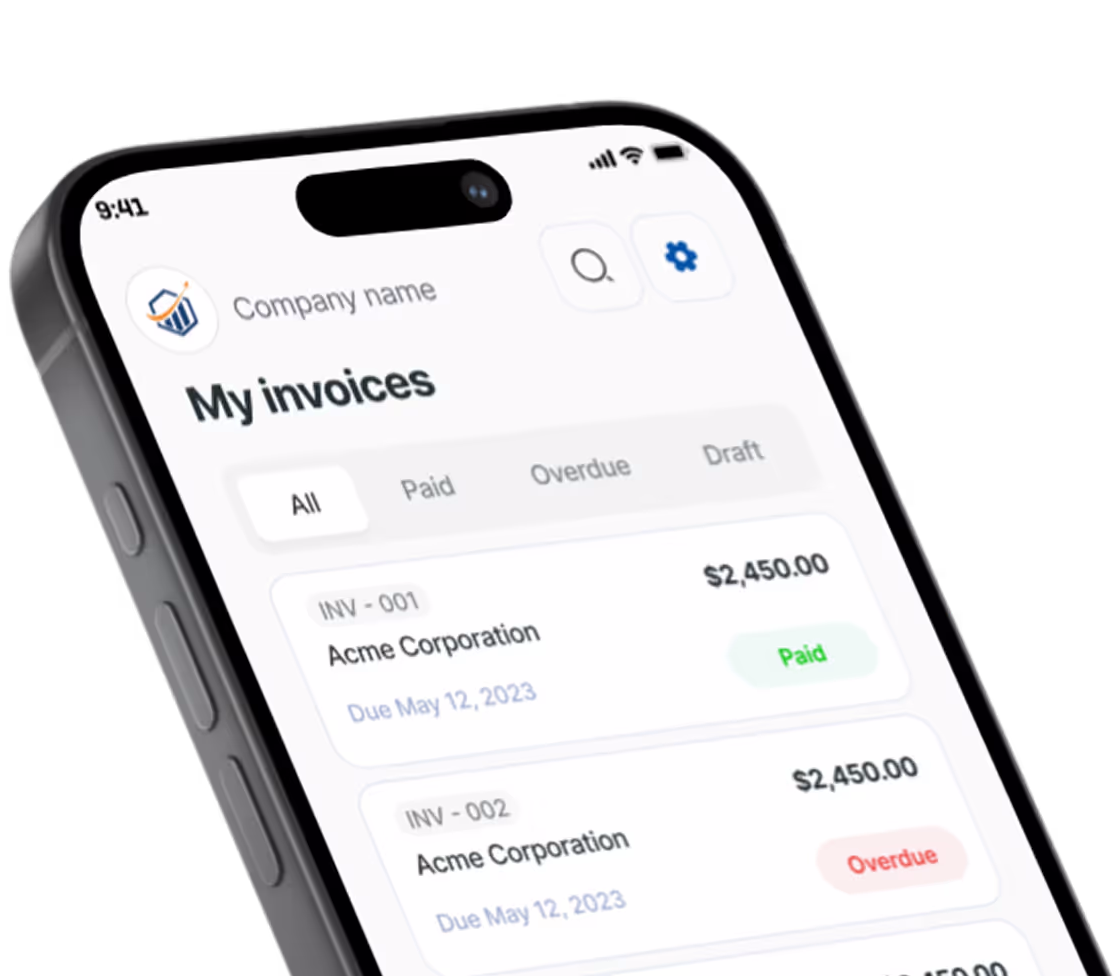

Work happens everywhere. You might finish a project on your laptop at a coffee shop, during travel, or between client meetings. The best freelance invoice software fits this reality—letting you invoice from anywhere on mobile, not just from your desk.

The rest of this guide addresses these challenges with practical solutions built specifically for freelance work.

When to Invoice: Timing Strategies for Freelancers

Invoice timing directly affects how fast you get paid. The right timing depends on project type, client relationship, and payment amount.

For Project-Based Work

Invoice immediately upon delivery. The moment you submit final deliverables, send your invoice. Client memory of your work’s value is highest at completion. Every day you wait decreases payment urgency.

Set calendar reminders. If you finish a project late on Friday, you might not think to invoice until Monday. By then, the client has moved on mentally. Set a system: deliverable sent equals invoice sent.

For Ongoing Retainer Work

Invoice at the same time each month. Predictability helps both parties. If you invoice on the first of each month, clients build it into their payment cycles.

Invoice in advance for retainers. For ongoing relationships, invoice at the beginning of the service period, not the end. This reinforces that retainer fees are for availability and priority access, not just hours worked.

For Milestone-Based Projects

Invoice at each milestone. Do not wait until project completion. Structure larger projects with payment checkpoints:

| Milestone | Typical Timing | Payment |

|---|---|---|

| Project start | Upon signed agreement | 25-50% |

| Concept/discovery complete | After initial direction approved | 15-25% |

| First draft/proof | At first major deliverable | 15-25% |

| Final delivery | Upon completion | Remaining balance |

This structure protects you from scope creep and client non-payment while giving clients predictable payment timing.

For Rush Work

Invoice before you start. Rush fees deserve rush payment. Requiring payment before beginning rush work is not just reasonable—it is standard practice. If a client needs something urgently enough to pay premium rates, they need it urgently enough to pay upfront.

Invoice Numbering: Building a System That Scales

Your invoice numbering system matters more than you think. Tax time, client disputes, and your own record-keeping all depend on organized, unique invoice numbers.

Numbering Options for Freelancers

Sequential numbering: Start at 001 and increment. Simple, but reveals your business volume (Invoice #004 tells clients you are new).

Year-based sequential: 2025-001, 2025-002. Resets each year, provides context, looks professional regardless of volume.

Client-coded: ABC-001, ABC-002 for client ABC. Useful if you do heavy repeat business with few clients.

Date-based: 20251215-01 (December 15, 2025, first invoice of day). Creates unique numbers automatically but can look sterile.

The Best Approach for Most Freelancers

Use year-based sequential numbering with a prefix: INV-2025-001. This format:

- Never duplicates (year resets provide infinite runway)

- Looks professional regardless of volume

- Sorts chronologically in any system

- Provides year context at a glance

Most invoice software for freelancers handles numbering automatically, preventing duplicates even when you invoice from multiple devices. With Pronto Invoice, numbers sync across your phone, tablet, and desktop—you will never accidentally send two clients the same invoice number. For a deeper dive into numbering strategies, see our invoice numbering best practices guide.

Freelancer Payment Terms That Actually Work

Standard business payment terms (Net 30, Net 60) were designed for corporate transactions, not freelance creative work. Adapt them to fit your reality. For a complete breakdown of all payment terms and when to use each, see our invoice payment terms guide.

Recommended Payment Terms by Project Size

Under $500: Due on receipt or Net 7. Small projects should mean fast payments.

$500-$2,500: Net 15. Reasonable time for client processing without extended delays.

$2,500-$10,000: Net 30. Standard for most professional freelance work.

Over $10,000: Net 30 with milestone payments. Never put more than $5,000 at risk on a single payment.

Payment Terms for Different Client Types

Small businesses and solopreneurs: Net 15 or Due on receipt. They typically pay faster and have simpler approval processes.

Agencies: Net 30. They often wait for their client to pay before paying you—build this into your cash flow planning.

Corporate clients: Net 30-45. Larger organizations have procurement processes. Getting into their vendor system takes time, but they typically pay reliably.

International clients: Net 30 plus 5-7 days for transfer time. See the international section below.

Encouraging Faster Payment

Add incentives to accelerate payment without demanding it:

- 2% discount for payment within 10 days (written as “2/10 Net 30”)

- Payment plans for larger projects (spreads your risk, increases accessibility)

- Multiple payment methods (credit card, ACH, PayPal, wire—remove friction)

Deposits and Upfront Payments: Protecting Your Work

Deposits are not optional for freelancers. They are standard practice that protects your time, filters serious clients from tire-kickers, and ensures you are compensated if projects stall.

Standard Deposit Amounts

Creative projects (design, photography, video): 50% upfront, 50% on delivery. Creative work cannot be “returned,” so significant upfront payment is industry standard.

Development and technical work: 25-50% upfront. Technical projects often have clear milestones that enable milestone billing.

Consulting and strategy: 100% upfront for short engagements, or first month’s retainer in advance for ongoing work. See our consulting invoice guide for more details.

Writing and content: 50% upfront for first-time clients, with established clients you might move to payment on delivery.

Communicating Deposit Requirements

Frame deposits as standard practice, not negotiable terms:

“My standard terms are 50% to begin work, with the remaining 50% due upon delivery. This reserves your project slot on my calendar and allows me to dedicate focused time to your project.”

Clients who refuse deposits are signaling future payment problems. Consider it a valuable filter.

Handling Deposit Pushback

If a client pushes back on deposit requirements:

- Explain the reasoning: “This protects both of us and lets me commit fully to your timeline.”

- Offer alternatives: “For your first project with me, I can offer Net 15 terms if your company has a purchase order process that makes deposits difficult.”

- Know when to walk away: Clients who will not pay a deposit often will not pay at all.

Kill Fees and Cancellation Clauses: When Projects End Early

Projects get cancelled. Budgets get cut. Priorities shift. Without kill fee provisions, you absorb the loss of work you turned down, time you invested, and opportunities you missed.

What Kill Fees Should Cover

Time already invested. Any hours spent on the project should be billed at your full rate.

Opportunity cost. You blocked this time for this client. A cancellation fee compensates for work you turned away.

Materials and expenses. Any non-refundable purchases made for the project.

Standard Kill Fee Structures

Before work begins: Deposit is non-refundable (covers reserved calendar time).

During discovery/planning phase: 50% of total project fee, or full payment for time spent plus 25% of remaining project value.

After substantial work completed: Full payment for work completed plus 50% of remaining project value, or negotiate delivery of work completed for payment to date.

Kill Fee Language for Contracts

Include kill fee terms in every project agreement:

“If Client cancels this project before completion, Client agrees to pay for all work completed at the contracted rates plus 50% of the remaining project balance as a cancellation fee. All deposits are non-refundable.”

Projects with kill fee clauses rarely get cancelled frivolously. The clause itself creates commitment.

Handling Late Payments: Professional Persistence

Late payments happen to every freelancer. How you handle them determines whether you get paid and whether you preserve the client relationship.

The Late Payment Timeline

Day of due date: Send a friendly reminder if payment has not arrived. “Just a quick note that invoice #2025-034 was due today. Let me know if you need anything from me to process payment.”

7 days overdue: Follow up directly. “Following up on invoice #2025-034, now 7 days past due. Is there an issue with payment processing I can help resolve?”

14 days overdue: Escalate tone and urgency. “Invoice #2025-034 is now two weeks overdue. Please confirm payment will be processed this week, or let me know if we need to discuss an alternative arrangement.”

30 days overdue: Final notice before consequences. “This is a final notice regarding invoice #2025-034, now 30 days past due. If payment is not received within 7 days, I will need to pause any current work and consider additional collection steps.”

45+ days overdue: Consider collection options (small claims court, collection agency, or write-off and blacklist).

Late Payment Prevention

The best approach is preventing late payments in the first place:

- Invoice immediately upon completion. Fresh work gets prioritized.

- Include payment links. One-click payment removes friction. The best freelance invoice software makes paying as easy as clicking a button.

- Send reminders before due dates. A reminder 3 days before due date catches payments that might otherwise slip.

- Use automated reminders. Set up your invoicing software to send reminders automatically so you never have to remember.

Late Payment Fees

Include late payment terms on every invoice:

“Late payments subject to 1.5% monthly interest (18% annually) after 15 days past due.”

Whether you enforce this is situational, but having it documented gives you leverage and establishes expectations.

Invoicing International Clients: Currency, Taxes, and Transfers

International freelancing is increasingly common—and increasingly complex. Different currencies, tax requirements, and payment methods require attention.

Currency Decisions

Invoice in your currency: Simpler for you, but client bears exchange rate risk and fees.

Invoice in client’s currency: More client-friendly, but you absorb exchange fluctuations.

Best practice: Invoice in USD for most international work (widely accepted, stable) or client’s local currency for major markets (EUR, GBP, CAD, AUD). Use exchange rate clauses for long-term contracts.

Payment Method Considerations

Wire transfers: Standard for larger payments but expensive ($25-50 fees common). Best for invoices over $1,000.

PayPal/Wise/Payoneer: Lower fees, faster transfers, but currency conversion costs add up. Best for regular international clients.

Credit cards: Highest fees but most convenient. Accept for clients who prefer it.

ACH/domestic transfers: Only work within a country’s banking system.

International Payment Terms

Add extra time for international payments:

- Standard Net 30 becomes Net 35-40

- Wire transfers can take 3-5 business days

- Some countries have currency controls that cause delays

Tax Considerations

Collect and document W-8BEN forms from international clients (if you are US-based) or equivalent tax documentation for your country.

Understand VAT/GST requirements. If invoicing clients in the EU, UK, Australia, or other regions, you may need to handle VAT correctly.

Consult a tax professional for regular international work. The complexity justifies the cost.

Building Invoicing Into Your Client Contracts

Your invoice is only as enforceable as your underlying agreement. Build invoicing terms into every client contract.

Essential Contract Payment Clauses

Payment terms: Specific due dates, acceptable payment methods, and late payment consequences.

Deposit requirements: Amount, when due, and non-refundable status.

Milestone schedule: For larger projects, tie payments to specific deliverables.

Kill fee/cancellation terms: What happens if the client cancels.

Revision limits: How many rounds are included before additional billing applies.

Scope change process: How additional work will be quoted and billed.

Rights transfer: When ownership transfers (typically upon full payment).

The Revision Clause

Creative work invites endless revisions without clear boundaries:

“This project includes two rounds of revisions on each major deliverable. Additional revisions will be billed at $X per hour with a one-hour minimum per revision round.”

This clause prevents scope creep while remaining client-friendly for reasonable requests.

How to Choose the Best Freelance Invoice Software

Your invoicing process is only as good as your tools. The best freelance invoice software for your situation depends on how you work. Here is what to evaluate when comparing options.

Essential Features for Freelancers

Mobile accessibility. Freelancers do not work 9-to-5 at desks. You need to invoice from anywhere—between client meetings, from your car, during travel. Mobile-first design matters.

Payment integration. Built-in payment processing (Stripe, PayPal) means clients can pay with one click. This alone can reduce payment time by days.

Automatic reminders. Manual follow-up is tedious and easy to forget. Automated reminders save hours and prevent late payments.

Professional templates. Your invoice represents your brand. Clean, professional freelance invoice templates reinforce your value.

Expense tracking. For project-based billing with reimbursable expenses, integrated expense tracking simplifies invoicing.

Client management. Storing client details, payment history, and project information in one place prevents re-entering data.

Comparing Popular Invoice Software for Freelancers

When evaluating freelance invoice software, consider these factors:

| Feature | Why It Matters for Freelancers |

|---|---|

| Mobile app | Invoice from job sites, coffee shops, anywhere |

| One-click payments | Faster payment = better cash flow |

| Automated reminders | Never manually chase payments again |

| QuickBooks sync | Tax time preparation |

| Recurring invoices | Retainer client billing |

| Time tracking | Hourly billing accuracy |

Pronto Invoice was built with freelancers in mind—mobile invoicing that works between client meetings and creative sessions, with one-click payment links, automated reminders, and professional templates that match how creative professionals actually work. When you finish a project at midnight or wrap a client meeting at a coffee shop, you can invoice immediately from your phone before the moment passes. Learn how to format an invoice properly to maximize your professionalism.

Beyond Basic Invoicing

As your freelance business grows, look for tools that support:

- Recurring invoices for retainer clients

- Time tracking integration for hourly work

- Reporting to understand income patterns

- Accounting sync (QuickBooks, Xero) for tax preparation

Building Your Complete Freelance Invoicing System

Getting paid consistently requires a system, not just software. Here is how to put everything together:

Step 1: Set Your Standard Terms

Decide on default freelancer payment terms, deposit requirements, and late payment policies. Write them down. Apply them consistently.

Step 2: Create Your Contract Template

Build a contract that includes all payment terms, revision limits, and cancellation clauses. Use it for every project.

Step 3: Choose Your Invoicing Tools

Select the best freelance invoice software that fits how you work. Prioritize mobile access and payment integration over complex features you will not use.

Step 4: Establish Your Process

Define when you invoice (immediately upon delivery), how you follow up (automated reminders plus personal outreach), and when you escalate (after 30 days).

Step 5: Protect Your Cash Flow

Use deposits for new clients, milestone billing for large projects, and never let receivables exceed what you can afford to lose from any single client.

Frequently Asked Questions About Freelance Invoicing

What is the best freelance invoice software for beginners?

The best freelance invoice software for beginners combines simplicity with essential features. Look for tools with professional templates, built-in payment processing, and mobile apps. Pronto Invoice offers a 5-step invoice creation process that takes under 60 seconds, making it ideal for freelancers new to invoicing.

How often should freelancers send invoices?

Invoice immediately upon project completion for one-time work. For ongoing clients, establish a consistent schedule—weekly, bi-weekly, or monthly depending on project volume. Consistency helps clients budget and builds predictable cash flow.

What payment terms should freelancers use?

Most freelancers use Net 15 for smaller projects under $2,500 and Net 30 for larger engagements. Always require deposits (25-50%) for new clients and large projects. Offer early payment discounts (2/10 Net 30) to incentivize faster payment.

How do I handle clients who pay late?

Start with friendly reminders on the due date, then escalate communication at 7, 14, and 30 days overdue. Include late payment fees in your contracts (typically 1.5% monthly). For chronic late payers, require deposits or upfront payment on future projects.

Should I use free invoice software or paid tools?

Free invoice software works for occasional invoicing but often lacks payment integration, automated reminders, and professional templates. Paid tools like Pronto Invoice typically pay for themselves through faster payments and time saved on manual follow-up.

Start Getting Paid Faster Today

Freelance invoicing does not have to be complicated. The right invoice software for freelancers, combined with clear processes, transforms payment headaches into predictable income:

- Invoice immediately when work is complete—same-day invoicing is the single biggest factor in faster payment

- Require deposits for new clients and large projects

- Include payment links to remove friction

- Set up automated reminders so you never have to chase payments manually

- Document everything in contracts before work begins

Your creative work deserves professional payment processes. Every professional invoice you send reinforces your value and moves you closer to sustainable freelance income.

Ready to streamline your freelance invoicing? Try Pronto Invoice free and send your first professional invoice in under 60 seconds.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.