Business Structure Types: LLC vs Sole Proprietor vs S-Corp Explained

Compare LLC vs sole proprietor vs S-Corp. Learn tax, legal, and invoicing differences to choose the right structure.

Choosing the right business structure is one of the most consequential decisions you will make as a business owner. The business structure types you consider affect how much you pay in taxes, whether your personal assets are protected if something goes wrong, and even how you handle everyday tasks like invoicing clients and processing payments.

Yet many contractors, freelancers, and service business owners operate for years without fully understanding their options. Some stick with the default sole proprietorship because it was easy. Others form an LLC without knowing the tax implications. And plenty of growing businesses miss the window to switch to an S-Corp and end up overpaying in self-employment taxes.

This guide breaks down the three most common business structure types — sole proprietorship, LLC, and S-Corp — with a specific focus on what matters to service-based businesses. You will learn the legal protections, tax implications, costs, and complexity of each option, plus a clear framework for choosing a business structure that fits your situation.

Table of Contents

- Why Business Structure Types Matter for Service Businesses

- Sole Proprietorship: The Default Starting Point

- LLC: Liability Protection Without Corporate Complexity

- S-Corp for Small Business: Tax Optimization for Growing Companies

- Side-by-Side Business Entity Comparison

- How Your Business Structure Affects Invoicing and Payments

- Decision Framework: Choosing a Business Structure

- Common Mistakes When Choosing Business Structure Types

- When to Change Your Business Structure

- Taking Action on Your Business Structure Decision

- Frequently Asked Questions About Business Structure Types

Why Business Structure Types Matter for Service Businesses

Your business structure is not just paperwork — it creates the legal and financial foundation for everything you do. For service businesses specifically, the stakes are high.

Legal liability is real. A plumber who accidentally floods a client’s basement, an electrician whose work causes a fire, or a photographer who loses irreplaceable wedding photos all face potential lawsuits. Your business structure determines whether plaintiffs can go after your house, savings, and personal assets.

Tax differences add up quickly. A contractor earning $150,000 per year could pay $10,000 or more in taxes as a sole proprietor compared to an S-Corp, depending on their situation. Over a decade, that is six figures in unnecessary tax payments.

Professionalism affects client perception. When you invoice a commercial client as “John Smith” versus “Smith Electrical Services, LLC,” it signals different levels of business maturity. Some corporate clients require vendors to have formal business structures before signing contracts.

Banking and payment processing depend on structure. Opening a business bank account, applying for a business credit card, or setting up payment processing all require documentation of your business structure. The wrong structure can create friction in getting paid.

Understanding business structure types is not optional — it is essential for protecting what you have built and setting yourself up for growth.

Sole Proprietorship: The Default Starting Point

A sole proprietorship is the simplest business structure type and the default for anyone who starts earning money independently. If you have done any freelance work, picked up side jobs, or started offering services without filing any paperwork, you are already operating as a sole proprietor.

How Sole Proprietorships Work

There is no legal distinction between you and your business. You report business income and expenses on Schedule C of your personal tax return. You can operate under your own name or file a DBA (Doing Business As) to use a business name.

Formation requirements: None. You are automatically a sole proprietor when you start business activity.

Ongoing requirements: Minimal. Depending on your location and industry, you may need local business licenses or permits, but there are no annual filings or formal meeting requirements.

Advantages of Sole Proprietorship

Zero startup costs. No formation fees, no registered agent requirements, no annual report filings.

Simplest tax filing. Your business income flows directly to your personal return. One tax return covers everything.

Complete control. No partners, shareholders, or board members to consult. Every decision is yours.

Easy to dissolve. If you stop doing business, you simply stop. No formal dissolution process required.

Disadvantages of Sole Proprietorship

No liability protection. This is the critical weakness. If your business is sued, creditors can pursue your personal assets — your home, car, savings accounts, and everything else you own.

Self-employment tax burden. You pay the full 15.3% self-employment tax (Social Security and Medicare) on all net earnings. There is no way to optimize this within a sole proprietorship.

Limited credibility. Some clients, especially larger companies, prefer working with formally structured businesses.

Harder to raise capital. Banks and investors typically want to see a formal business structure before providing financing.

Who Should Choose a Sole Proprietorship

Sole proprietorship makes sense for:

- Side hustlers testing a business idea before committing

- Very low-risk services with minimal liability exposure

- Businesses earning under $20,000 to $30,000 annually where formation costs outweigh benefits

- Temporary or short-term projects

For most service businesses that plan to grow, sole proprietorship should be a starting point, not a permanent structure.

LLC: Liability Protection Without Corporate Complexity

A Limited Liability Company (LLC) is the most popular business structure type for small service businesses, and for good reason. When comparing LLC vs sole proprietor options, the LLC provides meaningful liability protection while maintaining operational simplicity.

How LLCs Work

An LLC is a legal entity separate from its owners (called members). This separation creates a liability shield — the company’s debts and legal obligations belong to the LLC, not to you personally.

Formation requirements: File Articles of Organization with your state (typically $50 to $500 depending on the state). Most states require naming a registered agent who can receive legal documents.

Ongoing requirements: Most states require annual reports and fees ($0 to $800 annually depending on location). California is notably expensive with an $800 annual minimum franchise tax.

Tax Treatment Options for LLCs

One of the most misunderstood aspects of LLCs is taxation. By default, a single-member LLC is taxed as a sole proprietorship — income passes through to your personal return just like before. A multi-member LLC is taxed as a partnership.

However, LLCs can elect different tax treatment:

- Default (disregarded entity/partnership): Pass-through taxation with self-employment taxes

- S-Corp election: File Form 2553 to be taxed as an S-Corp while maintaining LLC legal structure

- C-Corp election: Rarely beneficial for small service businesses

This flexibility is one of the key advantages in the LLC vs sole proprietor comparison and makes the LLC structure extremely versatile.

Advantages of LLC

Liability protection. Your personal assets are generally protected from business debts and lawsuits. If your landscaping company is sued for property damage, the plaintiff can only pursue company assets, not your personal savings.

Pass-through taxation. No double taxation like C-Corps. Profits flow to members and are taxed once on personal returns.

Flexibility in profit distribution. Unlike S-Corps, profit distribution does not have to match ownership percentages. Operating agreements can customize nearly every aspect of how the business runs.

Tax election options. You can maintain LLC legal status while electing S-Corp tax treatment to reduce self-employment taxes.

Credibility boost. “LLC” after your business name signals legitimacy to clients and vendors.

Disadvantages of LLC

Formation and maintenance costs. Depending on your state, expect $100 to $500 to form and $0 to $800 annually to maintain.

Self-employment taxes still apply. Unless you elect S-Corp taxation, you pay self-employment tax on all profits — same as a sole proprietor.

Some complexity added. You should maintain a separate business bank account, keep records of major decisions, and avoid mixing personal and business finances (which could pierce the liability shield).

Who Should Choose an LLC

LLC is the right choice for:

- Service businesses with meaningful liability exposure (contractors, consultants, professional services)

- Businesses earning enough that formation costs are negligible relative to revenue

- Owners who want flexibility to add S-Corp taxation later

- Anyone who values asset protection

Most field service professionals, freelancers, and small service businesses should strongly consider forming an LLC.

S-Corp for Small Business: Tax Optimization for Growing Companies

An S-Corporation is not actually a business structure type in the legal sense — it is a tax classification. You can form an LLC and elect S-Corp tax treatment, or you can form a corporation and elect S-Corp status. Either way, the tax treatment works the same. Understanding how an S-Corp for small business works is critical once your revenue grows past certain thresholds.

How S-Corp Taxation Works

The key difference with S-Corp taxation is how you pay yourself. Instead of taking all profits as self-employment income (which triggers the 15.3% SE tax), you split compensation into two buckets:

Reasonable salary: You pay yourself W-2 wages for work you perform. Both you and the company pay payroll taxes on this amount.

Distributions: Remaining profits can be taken as shareholder distributions, which are NOT subject to self-employment tax.

This split can create significant tax savings for profitable businesses.

S-Corp Tax Savings Example

Consider Sarah, a freelance graphic designer earning $120,000 in net profit.

As a sole proprietor or standard LLC:

- Self-employment tax: $120,000 x 15.3% = $18,360

- (The Social Security portion caps at the wage base of $176,100 in 2025, but the 2.9% Medicare portion continues on all income)

As an S-Corp with $60,000 salary:

- Payroll taxes on salary: $60,000 x 15.3% = $9,180

- Self-employment tax on $60,000 distributions: $0

- Total savings: approximately $9,180 per year

The IRS requires that your salary be “reasonable” for the work you perform. You cannot pay yourself a $10,000 salary while taking $110,000 in distributions. Industry norms, hours worked, and geographic factors all influence what is considered reasonable.

S-Corp Eligibility Requirements

Not every business qualifies for S-Corp status. The IRS imposes specific restrictions:

- Maximum of 100 shareholders

- Only one class of stock allowed

- All shareholders must be U.S. citizens or resident aliens

- Certain entities (partnerships, corporations, most trusts) cannot be shareholders

These restrictions rarely affect solo service businesses but become relevant if you plan to bring on investors or partners.

Advantages of S-Corp for Small Business

Reduced self-employment taxes. For businesses earning roughly $60,000 or more in net profit, the tax savings often exceed the additional costs and complexity.

Same liability protection. If structured as an LLC with S-Corp election, you maintain the LLC’s liability shield.

Credibility and structure. The formal payroll and documentation requirements can actually be beneficial, creating clear records and professional operations.

Disadvantages of S-Corp

Payroll requirements. You must run payroll, file quarterly payroll tax returns, and issue W-2s. This adds cost (expect $200 to $1,000 or more annually for payroll services) and administrative burden.

Stricter IRS scrutiny. The IRS watches S-Corps for unreasonably low salaries. Getting audited for paying yourself too little is a real risk.

Less flexibility than LLCs. S-Corps have restrictions on profit allocation — distributions must be proportional to ownership, unlike LLCs where operating agreements can customize profit splits.

Quarterly estimated taxes become more complex. You are managing both personal estimated taxes and payroll tax deposits.

State-level tax variations. Not all states treat S-Corps the same way the federal government does. Some states impose additional taxes on S-Corp income, and a few do not recognize the S-Corp election at all. Check your state’s specific treatment before electing.

Who Benefits Most from S-Corp Election

S-Corp taxation makes sense when:

- Net business profit consistently exceeds $60,000 to $80,000 annually

- You are prepared to handle payroll administration (or pay for payroll services)

- Your income is stable enough to set a reasonable salary

- You have professional tax advice confirming the benefits for your situation

For newer or lower-revenue businesses, the complexity typically outweighs the tax savings.

Side-by-Side Business Entity Comparison

This business entity comparison table summarizes the key differences across all three structures:

| Factor | Sole Proprietorship | LLC (Default Tax) | LLC with S-Corp Election |

|---|---|---|---|

| Formation Cost | $0 | $50-500 | $50-500 + S-Corp filing |

| Annual Maintenance | $0 | $0-800 | $0-800 + payroll costs |

| Liability Protection | None | Yes | Yes |

| Self-Employment Tax | Full 15.3% on all profit | Full 15.3% on all profit | Only on salary portion |

| Tax Filing | Schedule C | Schedule C (single member) | Form 1120-S + payroll returns |

| Payroll Required | No | No | Yes |

| Profit Allocation Flexibility | N/A | High (via operating agreement) | Must match ownership % |

| Best Annual Net Profit | Under $30K | $30K-$80K | Over $80K |

| Complexity Level | Minimal | Low | Moderate |

How Your Business Structure Affects Invoicing and Payments

Your business structure has practical implications for how you invoice clients and receive payments — something many business owners do not consider until they run into problems.

Business Name on Invoices

Sole proprietors can invoice under their personal name or a DBA. However, some payment processors and clients may question payments made to individual names rather than business names.

LLCs and S-Corps invoice under the registered business name. This creates cleaner documentation and fewer questions from clients’ accounting departments.

Bank Account and Payment Processing

Opening a business bank account typically requires your formation documents. Sole proprietors can often use personal accounts, but this creates problems:

- Mixing personal and business funds makes bookkeeping difficult

- It can pierce the LLC liability protection if you later form one

- Payment processors may flag inconsistencies between business names and account names

With an LLC or S-Corp, you will have proper business banking that aligns with your invoices, contracts, and payment processing accounts.

Tax Documentation for Clients

Clients paying you $600 or more annually will request a W-9 form. Your business structure affects what you report:

- Sole proprietors typically use their SSN (or an EIN if they have one)

- LLCs should always use an EIN

- S-Corps use an EIN and report as a corporation

Having an EIN adds privacy protection — you are not handing your Social Security number to every client.

Professional Invoicing Practices

Regardless of structure, professional invoicing practices build client trust and accelerate payments. Your invoices should clearly display:

- Your legal business name

- Business address

- EIN or tax ID (when required)

- Consistent branding that matches your contracts

- Clear payment terms so clients know exactly when payment is due

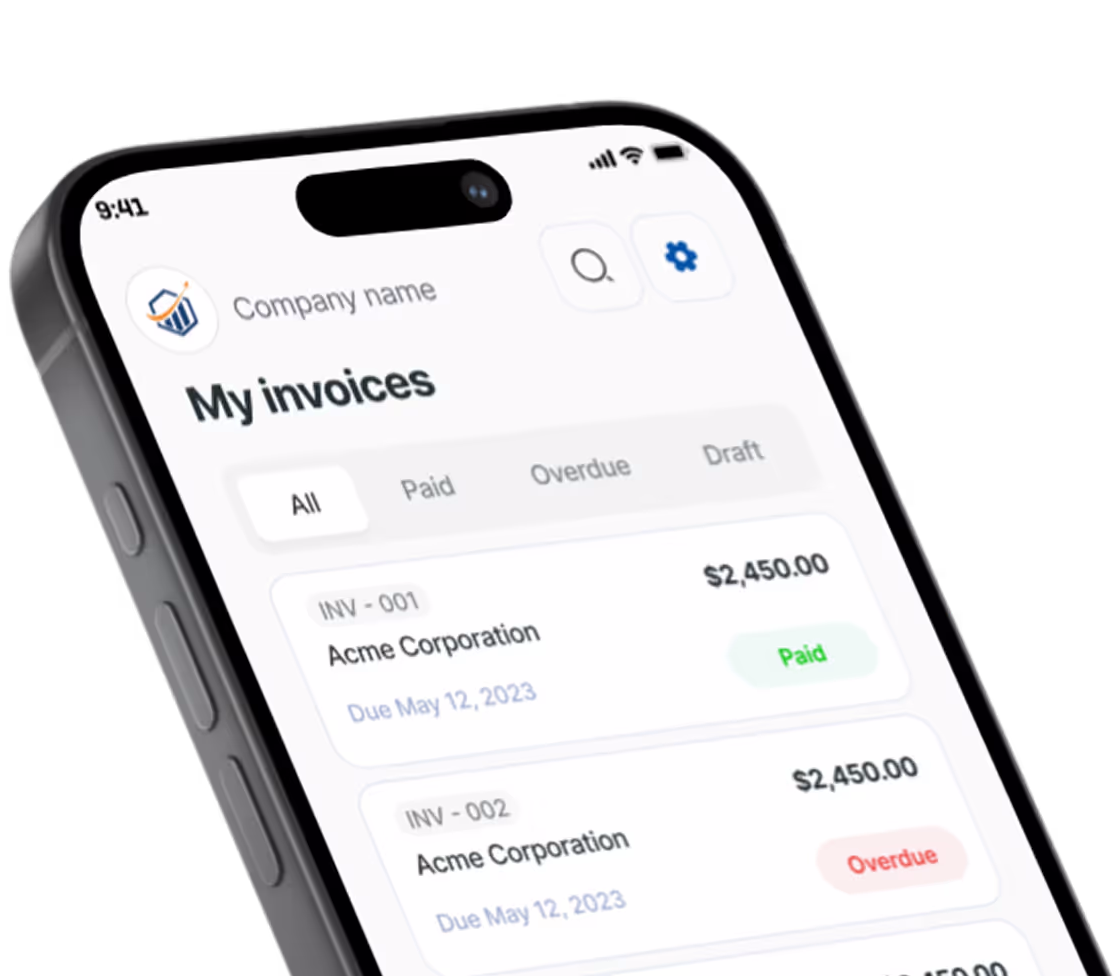

Using dedicated invoicing software ensures your documentation is consistent and professional. Mobile invoicing solutions like Pronto Invoice allow service professionals to create and send invoices immediately after completing work — before leaving the job site — which dramatically improves cash flow regardless of your business structure.

Decision Framework: Choosing a Business Structure

Use this framework to identify the right business structure type for your situation.

Step 1: Assess Your Liability Risk

High liability exposure (contractors, electricians, plumbers, anyone whose work could cause property damage or injury): LLC is the minimum recommended structure.

Moderate liability exposure (consultants, designers, most professional services): LLC strongly recommended.

Low liability exposure (minimal client interaction, low-risk services): Sole proprietorship may be acceptable short-term.

Step 2: Evaluate Your Revenue Level

- Under $30,000 net profit: Sole proprietorship or LLC with default taxation

- $30,000 to $80,000 net profit: LLC with default taxation (S-Corp benefits may not outweigh costs)

- Over $80,000 net profit: Strongly consider LLC with S-Corp election

Step 3: Consider Your Growth Plans

If you plan to:

- Hire employees: LLC minimum, S-Corp beneficial

- Bring on partners: LLC with operating agreement

- Seek business loans or investment: Formal structure required

- Sell the business eventually: Corporate or LLC structure preferred

Step 4: Factor in Your State

State-specific costs matter. California’s $800 minimum franchise tax for LLCs makes the calculus different than in Wyoming where LLCs cost under $100 annually. Some states also impose additional taxes on S-Corp income or do not fully recognize the S-Corp election. Research your specific state’s requirements before choosing a business structure.

Step 5: Get Professional Input

Tax implications vary based on your complete financial picture. A consultation with a CPA or tax attorney (typically $200 to $500) can confirm whether your analysis is correct before you make changes.

Common Mistakes When Choosing Business Structure Types

Avoiding these errors can save you thousands of dollars and significant headaches.

Mixing Personal and Business Finances

Even after forming an LLC, many business owners continue using personal bank accounts for business transactions. This is called “commingling funds” and it can pierce the corporate veil — meaning a court could hold you personally liable despite your LLC status. Open a dedicated business bank account and keep all business income and expenses separate.

Choosing an S-Corp Too Early

The S-Corp tax savings only work when your net profit is high enough to offset the added costs of payroll processing, additional tax filings, and accounting fees. A solo freelancer earning $40,000 does not need an S-Corp. The complexity and costs will outweigh any benefits until net profit consistently exceeds $60,000 to $80,000.

Ignoring State-Specific Rules

Business structure costs and requirements vary dramatically by state. An LLC in Wyoming costs under $100 per year. The same LLC in California triggers an $800 annual franchise tax regardless of revenue. Some states also charge additional taxes on S-Corp income. Always research your state’s specific rules before making a decision.

Setting an Unreasonably Low S-Corp Salary

The IRS requires S-Corp owners to pay themselves a “reasonable salary” before taking distributions. Setting your salary too low to maximize tax-free distributions is one of the most common audit triggers for S-Corps. Use industry salary data and consult a CPA to set a defensible salary amount.

Skipping the Operating Agreement

Many single-member LLC owners skip creating an operating agreement because it is not always required by the state. However, an operating agreement strengthens your liability protection by documenting the separation between you and the business. Banks, investors, and courts may all look for this document.

When to Change Your Business Structure

Business structures are not permanent. As your business grows, the optimal structure often changes.

Signs You Should Form an LLC

- You are operating as a sole proprietor with real liability exposure

- Your revenue is consistent enough that formation costs are negligible

- You are signing contracts with larger clients who expect formal structures

- You want cleaner separation between personal and business finances

Signs You Should Add S-Corp Election

- Your net profit has consistently exceeded $70,000 to $80,000 for one to two years

- You have stable, predictable income (not feast-or-famine cycles)

- You are prepared to run payroll or pay for payroll services

- A CPA has confirmed the tax savings exceed the additional costs

Timing Considerations

S-Corp elections must be filed within 2 months and 15 days of the start of the tax year to be effective for that year (Form 2553). Late elections are possible with reasonable cause.

LLC formation can happen any time. Many business owners form an LLC before the end of the year to start the new year with proper structure.

Taking Action on Your Business Structure Decision

Understanding business structure types is valuable, but action creates results. Here is your path forward:

If you are a sole proprietor with liability exposure: Research LLC formation in your state. Most states have straightforward online filing. Budget $100 to $500 for formation costs plus potential registered agent fees.

If you are an LLC owner with growing profits: Schedule a consultation with a CPA to run the numbers on S-Corp election. Bring your last two years of tax returns and a current profit estimate.

If you are just starting out: Focus on building revenue first. Use a simple structure (sole proprietorship or LLC) and upgrade when your revenue justifies it. If you need help with the full startup process, see our guide on steps to start a small business.

Regardless of structure: Get your invoicing and payment collection dialed in. Professional invoices, sent promptly, get paid faster. Pronto Invoice helps service businesses create professional invoices in under 60 seconds — directly from job sites, with or without internet connection. When you are ready to match your professional business structure with professional invoicing, start your free trial and see why thousands of contractors and freelancers trust it to get paid faster.

Frequently Asked Questions About Business Structure Types

What is the best business structure for a freelancer?

For most freelancers, an LLC offers the best balance of liability protection, tax flexibility, and simplicity. It protects your personal assets if a client sues, adds credibility, and costs relatively little to maintain. Once your net profit consistently exceeds $60,000 to $80,000, you can elect S-Corp taxation through the same LLC to reduce self-employment taxes.

Can I change my business structure later?

Yes. Business structures are not permanent. You can form an LLC at any time, and you can elect S-Corp tax treatment by filing Form 2553 with the IRS. The election must be filed within 2 months and 15 days of the start of the tax year to be effective for that year, though late elections with reasonable cause are sometimes accepted.

What is the difference between an LLC and an S-Corp?

An LLC is a legal business structure formed at the state level. An S-Corp is a federal tax classification. They are not mutually exclusive — you can form an LLC and then elect to be taxed as an S-Corp. The LLC provides liability protection, while the S-Corp election changes how your income is taxed to potentially reduce self-employment taxes.

How much does it cost to form an LLC?

LLC formation costs range from $50 to $500 depending on your state. Annual maintenance fees range from $0 to $800. Some states, like California, charge an $800 minimum annual franchise tax regardless of revenue. Other states, like Wyoming and New Mexico, have minimal ongoing costs.

Do I need an EIN if I am a sole proprietor?

An EIN is not legally required for sole proprietors with no employees, but it is strongly recommended. An EIN protects your personal Social Security number when filling out W-9 forms for clients, and it is required if you want to open a business bank account at most financial institutions.

At what income level should I consider an S-Corp?

Most CPAs recommend considering S-Corp election when your net business profit consistently exceeds $60,000 to $80,000 per year. Below that threshold, the costs of payroll processing, additional tax returns, and accounting fees typically offset the self-employment tax savings.

There is always something more to read

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.

How to Write a Painting Invoice That Gets You Paid Fast

Learn how to write a painting invoice that gets paid fast. Covers square footage billing, paint vs labor costs, and prep work itemization.

AI for Small Business: Your Practical Guide to AI Powered Invoicing Software

Learn what AI for small business can actually do. Discover AI powered invoicing software and practical tools that save time.