15 Essential Fields Every Professional Invoice Must Include

Learn the 15 essential invoice fields that protect your business, accelerate payments, and reinforce your brand.

A professional invoice does more than request payment—it protects your business, accelerates collections, and reinforces your brand. Missing critical fields leads to delayed payments, disputes, and accounting headaches. Here’s what every invoice needs.

1. Invoice Identification

Unique identifiers enable tracking, prevent duplicates, and simplify bookkeeping. A solid invoice numbering system is one of the most important decisions you will make for your business.

Include:

- Invoice number (e.g., INV-12345)

- Invoice date (creation date)

- Due date (payment deadline)

- Project name or reference (optional)

2. Business Information (Invoice From)

Your company details establish legitimacy and provide contact options.

Include:

- Company name

- Owner/contact name

- Business address

- Phone number

- Email address

- Website URL

- Company logo

- Tax ID/EIN (for tax compliance)

3. Client Information (Bill To)

Accurate client details ensure proper delivery and record-keeping.

Include:

- Client or company name

- Contact person’s name

- Email address

- Phone number

- Billing address

- Tax ID (for B2B transactions)

4. Shipping Information (Ship To)

When delivery differs from billing, separate shipping details prevent confusion.

Include:

- Recipient name

- Delivery address

- Contact phone number

- Special delivery instructions

5. Line Items Breakdown

Itemized charges demonstrate value and justify your pricing.

Include:

- Item name/service description

- Detailed description of work performed

- Quantity

- Unit of measure (hour, job, each, day)

- Unit price/rate

- Line total (quantity × price)

6. Pricing Summary

Clear calculations build trust and prevent payment disputes.

Include:

- Subtotal (sum of all line items)

- Discount (if applicable)

- Tax rate and amount

- Shipping/delivery fees

- Total amount due

7. Deposit and Balance Information

Track partial payments and remaining balances clearly.

Include:

- Deposit amount received

- Deposit date

- Balance due

- Payment history (for recurring clients)

8. Tax Information

Proper tax documentation ensures compliance and simplifies accounting.

Include:

- Tax rate percentage

- Tax amount calculated

- Tax jurisdiction

- Tax-exempt status (if applicable)

- Your tax ID number

9. Discount Details

Transparent discounts encourage prompt payment and client loyalty.

Include:

- Discount name/reason (e.g., “10% Early Payment”)

- Discount type (percentage or fixed)

- Discount amount

- Conditions for discount

10. Payment Methods

Multiple payment options accelerate collections.

Include:

- Accepted payment types:

- Credit/debit cards

- Bank transfer (ACH/wire)

- Digital wallets (Zelle, Venmo, PayPal, Cash App)

- Check

- Cash

- Bank details (account number, routing number, bank name)

- Digital payment handles/emails

- Payment links (for online payment)

11. Payment Terms and Instructions

Clear terms set expectations and reduce collection friction. For a deep dive into choosing the right terms, see our invoice payment terms guide.

Include:

- Payment due date

- Payment terms (Net 15, Net 30, Due on Receipt)

- Late payment penalties

- Early payment incentives

- Step-by-step payment instructions

12. Terms and Conditions

Legal protections safeguard your business interests.

Include:

- Payment policies

- Late fee structure

- Refund/cancellation policy

- Warranty information

- Liability limitations

- Dispute resolution process

13. Notes and Messages

Personalized communication strengthens client relationships.

Include:

- Thank you message

- Project-specific notes

- Next steps or follow-up items

- Special instructions

- Appreciation for their business

14. Signatures

Formal signatures create binding documentation.

Include:

- Company signature block:

- Signature image

- Printed name

- Date signed

- Client signature block (for approval):

- Signature line

- Printed name

- Date signed

15. Attachments and Supporting Documents

Visual documentation supports your charges and adds professionalism.

Include:

- Work photos (before/after)

- Receipts for materials

- Time logs

- Contracts or agreements

- Certifications or permits

Why Complete Invoices Matter

Professional invoices:

- Get paid faster — Clear details reduce questions and delays. Learn more about how to get customers to pay invoices faster

- Reduce disputes — Itemized charges justify every dollar

- Improve cash flow — Multiple payment options remove friction

- Build credibility — Professional presentation signals competence

- Simplify taxes — Complete records make accounting effortless

- Protect legally — Documentation supports collections if needed

Pro Tips for Better Invoices

- Invoice immediately — Send within 24 hours of project completion

- Use consistent numbering — Sequential numbers prevent duplicates

- Be specific — “Website redesign” beats “Services rendered”

- Offer multiple payment methods — Remove barriers to payment

- Set clear due dates — “Net 30” is clearer than “Payment due soon”

- Automate reminders — Follow up before and after due dates

- Include your branding — Logo and colors reinforce professionalism

- Make payment easy — Include direct payment links when possible

Common Invoice Mistakes to Avoid

- Missing or incorrect client information

- Vague line item descriptions

- No due date specified

- Single payment method only

- Missing tax information

- No invoice number for tracking

- Forgetting to include payment terms

- Sending invoices late

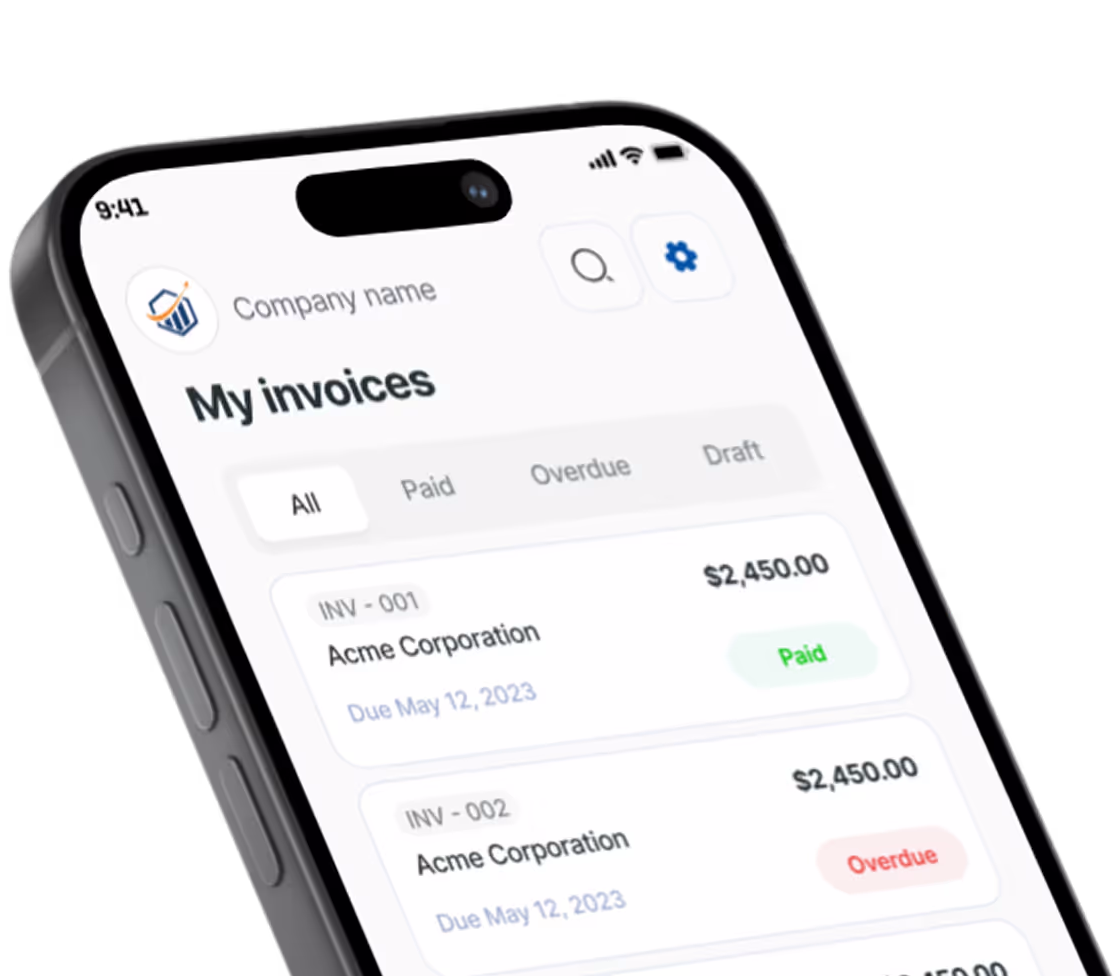

Create Professional Invoices in Under 60 Seconds

Stop losing time to manual invoicing. Modern invoicing software like Pronto Invoice lets you:

- Select clients from your saved database

- Add items from your product/service library

- Auto-calculate taxes, discounts, and totals

- Accept credit cards, bank transfers, and digital payments

- Send invoices via email or SMS instantly

- Track when clients view your invoice

- Convert estimates to invoices with one tap

- Get paid faster with integrated payment processing

Start creating professional invoices today.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.