How to Write an Invoice for Consulting Work: The Complete 2026 Guide

Learn how to write an invoice for consulting work that gets paid fast. Covers hourly vs project billing and retainers.

You delivered strategic advice that saved your client $50,000. You spent 20 hours analyzing their operations, another 10 in meetings, and countless more thinking through solutions. Now you need to write an invoice for consulting work that produced no physical deliverable—just expertise and time.

Learning how to write an invoice for consulting work creates a unique challenge. Unlike a contractor who can point to a finished deck or an electrician who installed new wiring, your value is intangible. Your consulting invoice must communicate professional worth while providing the documentation clients need to process payment without question.

This guide covers everything consultants need to know about invoicing: choosing between hourly and project-based billing, structuring retainer arrangements, documenting scope to prevent disputes, billing by milestone, and handling scope creep professionally when engagements evolve beyond original agreements.

Why Billing for Consulting Services Requires a Different Approach

Consulting sits at the intersection of time and value. You are not selling hours—you are selling outcomes, insights, and strategic advantage. But you still need to track time, document deliverables, and create invoices that justify your fees to clients who may not fully understand what you do behind the scenes.

This creates several invoicing challenges unique to consulting work:

Intangible deliverables. A 50-page strategy document is tangible. The strategic thinking that informed it is not. Your consulting invoice needs to communicate the value of both.

Variable engagement structures. Some clients need five hours of your time. Others need five months. Your invoicing approach must flex accordingly.

Corporate procurement requirements. Many consulting clients are larger organizations with purchase orders, approval hierarchies, and payment cycles that demand proper documentation. Understanding what a PO number is on an invoice becomes essential when billing corporate clients.

Scope that naturally evolves. Good consulting relationships grow. What starts as a marketing audit becomes a full strategy engagement. Managing this evolution financially requires clear processes.

The rest of this guide addresses each challenge with practical solutions you can implement immediately when writing invoices for consulting work.

Choosing Your Billing Model: Hourly vs Project-Based vs Retainer

Before you can invoice effectively, you need the right billing structure for each engagement. Each model has advantages depending on engagement type, client relationship, and your business goals. For a deeper dive into pricing strategy, see our guide on flat rate vs hourly billing.

Hourly Consulting Invoices

How it works: Charge a set rate for every hour worked. Track time meticulously and invoice based on actual hours.

Best for:

- Advisory work where scope is undefined

- Ongoing support relationships

- Clients who want to control spend through hours

- New engagements where you cannot predict effort

Advantages:

- Compensation for all time invested

- Clients only pay for work performed

- Easy to accommodate scope changes

- Lower risk on complex or uncertain projects

Disadvantages:

- Penalizes efficiency (faster work means less revenue)

- Clients may question time spent

- Revenue is unpredictable

- Can create adversarial dynamic around hours

Hourly consulting invoice requirements:

- Detailed time entries (date, hours, activity description)

- Clear hourly rate(s)

- Total hours and total fees

- Billing period dates

Project-Based (Fixed Fee) Consulting Invoices

How it works: Quote a single price for a defined scope of work. Invoice based on deliverables, not time.

Best for:

- Well-defined projects with clear deliverables

- Clients who need budget certainty

- Engagements where you can leverage expertise efficiently

- Repeat work where you know the effort required

Advantages:

- Rewards efficiency and expertise

- Predictable revenue for you, predictable cost for client

- Shifts focus from hours to outcomes

- Often allows higher effective hourly rates

Disadvantages:

- Risk falls on you if scope is underestimated

- Requires accurate scoping upfront

- Scope creep erodes margins

- Harder to accommodate client changes

Project-based consulting invoice requirements:

- Clear reference to project and milestone

- Deliverable descriptions

- Milestone payment amount per agreement

- Cumulative billing status

Retainer Invoice Arrangements

How it works: Client pays a fixed monthly fee for ongoing access and availability. May include set hours, specific services, or general advisory access.

Best for:

- Long-term advisory relationships

- Clients needing regular strategic input

- Predictable revenue goals

- Engagements where availability has value

Advantages:

- Predictable, recurring revenue

- Stronger client relationships

- Reduced sales cycle (ongoing vs. new projects)

- Premium for guaranteed access

Disadvantages:

- Can undervalue your time if poorly structured

- Scope boundaries require constant management

- Clients may feel entitled to unlimited access

- Unused retainer time creates guilt dynamics

Retainer invoice requirements:

- Monthly retainer fee

- Billing period covered

- Hours included (if applicable)

- Overage calculations

- Retainer balance summary

Hybrid Billing Approaches for Consultants

Many consultants blend models based on engagement type:

- Retainer plus hourly overage: Monthly fee covers base hours, additional work billed hourly

- Fixed fee phases with hourly discovery: Charge hourly for initial assessment, then quote fixed fee for implementation

- Milestone-based project fees: Fixed project price, invoiced in installments as milestones complete

Documenting Scope: Your First Line of Defense Against Payment Disputes

Every consulting payment dispute traces back to one issue: misaligned expectations about scope. What you thought you agreed to is not what the client believes they bought.

Prevent this with clear scope documentation before work begins.

Essential Scope Elements for Consulting Engagements

Objectives. What is the client trying to achieve? Write this in their words, not yours.

Deliverables. What tangible outputs will you produce? Be specific about format, length, and detail level.

Activities. What will you do to produce those deliverables? Client meetings, research, analysis, documentation.

Exclusions. What is explicitly not included? This matters as much as what is included.

Timeline. When will each deliverable be complete?

Assumptions. What must be true for this scope to hold? Client provides data by X date, stakeholders are available for interviews, etc.

Change process. How will you handle requests outside this scope?

A proper statement of work captures all of this. For smaller engagements, a detailed email confirmation can suffice—but get acknowledgment in writing.

Handling Scope Creep in Consulting Engagements

Scope creep is the gradual expansion of project requirements beyond the original agreement. It happens in every consulting engagement because:

- Clients discover new needs during the work

- Initial requirements were not fully understood

- The relationship is going well, so clients keep asking for more

- You want to be helpful and say yes

The problem is not scope change—it is uncompensated scope change. Good client relationships should grow. You just need a process to manage that growth financially.

Step 1: Recognize it. Train yourself to notice when requests fall outside agreed scope. This awareness is the first defense.

Step 2: Acknowledge the request. Never say no immediately. Say: “I can definitely help with that. Let me think through what that would involve.”

Step 3: Quantify the addition. Determine the additional time or effort required.

Step 4: Present options. Give the client choices:

- “We can add this to the current project for an additional $X”

- “We can swap this for Y in the original scope”

- “This would make sense as a Phase 2 project after we complete the current work”

Step 5: Document the change. If they agree to additional work, confirm via email or a formal change order before proceeding.

Step 6: Invoice clearly. When invoicing for additional work, reference the change order or email approval.

Milestone Billing for Consulting Projects: Protecting Cash Flow

For consulting engagements lasting more than a few weeks, milestone billing protects both parties and maintains healthy cash flow.

Common Milestone Structures for Consultants

50/50 Split:

- 50% at project start

- 50% upon completion

Works for shorter projects or established relationships.

Thirds:

- 33% at start

- 33% at midpoint

- 34% at completion

Balances cash flow with deliverable progress.

Monthly billing on fixed-fee projects:

- Divide total project fee by project duration

- Invoice monthly regardless of exact progress

- Adjust final invoice if project timeline changes

Works for engagements spanning multiple months.

Tying Milestones to Deliverables

The most effective milestone structure connects payments to specific deliverables:

| Milestone | Deliverable | Payment |

|---|---|---|

| Project Start | Signed SOW, kickoff meeting complete | 25% |

| Discovery Complete | Research findings report delivered | 25% |

| Strategy Draft | Draft recommendations presented | 25% |

| Project Close | Final deliverables and closeout meeting | 25% |

This approach makes invoicing straightforward: complete the deliverable, send the invoice.

Managing Milestone Invoicing Across Multiple Clients

Tracking milestones across multiple consulting clients quickly becomes complex. A project-based invoicing approach links each invoice to specific milestones, creating clean documentation of work performed and payments due.

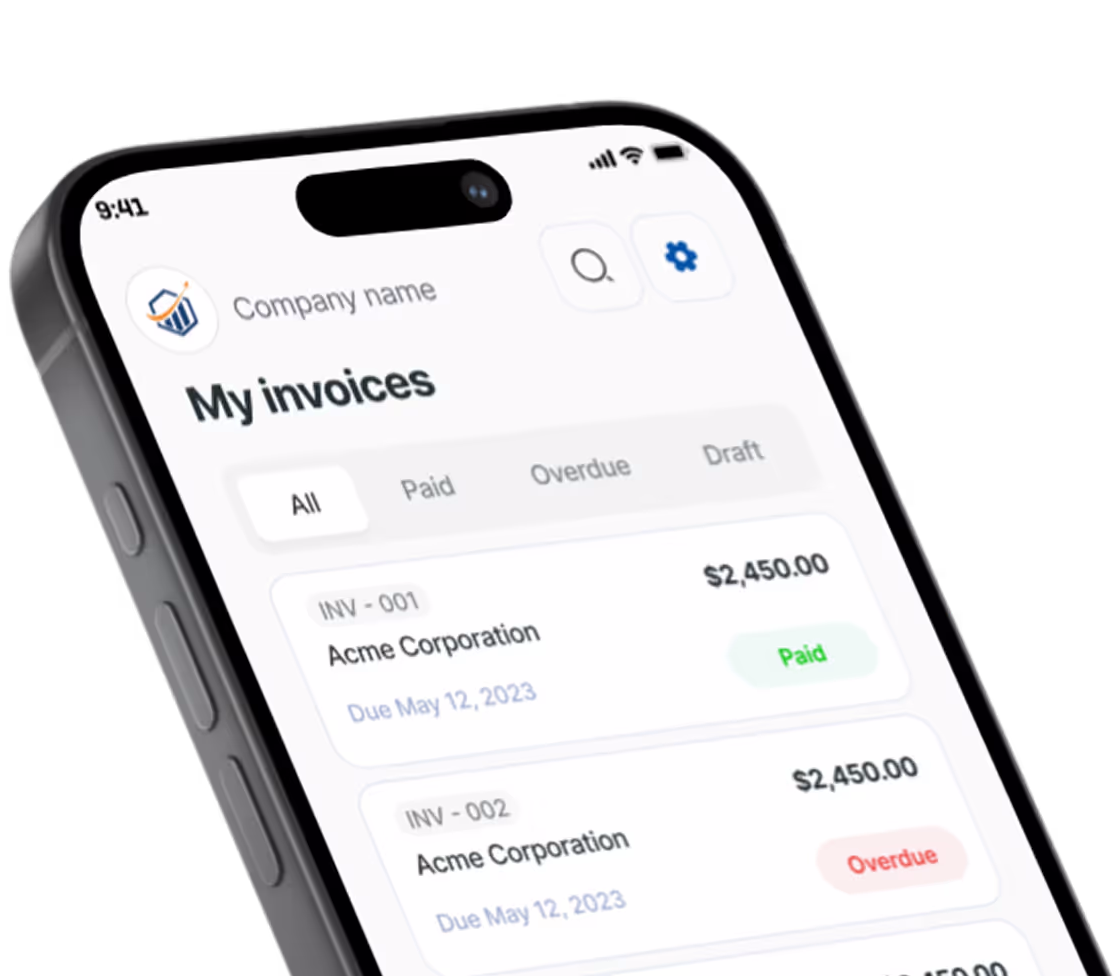

With Pronto Invoice, you can organize engagements by client and project, then generate milestone invoices that reference completed work. When clients ask about billing history or outstanding balances, everything connects back to documented deliverables.

What to Include on a Consulting Invoice: Required Elements

Every consulting invoice should include these elements to ensure prompt payment and clear documentation.

Header Information

- Your business name, address, contact information (see essential invoice fields for a complete list)

- Professional credentials or certifications (if relevant)

- Logo for brand recognition

Client Information

- Client organization name

- Billing contact name and address

- Project sponsor name (if different from billing contact)

Invoice Details

- Unique invoice number

- Invoice date

- Due date and payment terms

- PO number (if client requires)

Engagement Reference

- Project name or engagement title

- SOW or contract reference number

- Billing period covered

Service Description for Consulting Work

This is where consulting invoices differ from other service invoices. Your descriptions should communicate value, not just activity:

Weak description:

Consulting services - November 2024: $8,000

Strong description:

Strategic Marketing Assessment - Phase 2 (November 1-30, 2024)

- Completed competitive analysis covering 5 market segments

- Conducted stakeholder interviews (8 sessions, 12 participants)

- Delivered preliminary findings presentation to executive team

- Drafted strategic recommendations document (pending final review) Phase 2 fee per SOW dated 10/15/2024: $8,000

The strong description connects fees to tangible activities and deliverables, justifies the amount, and references the governing agreement.

Expense Reimbursement on Consulting Invoices

If your engagement includes expense reimbursement, create a separate section:

Professional Fees: $8,000 Expense Reimbursement:

- Travel (Chicago stakeholder meetings, 11/12-11/14): $1,247

- Research subscriptions (per SOW authorization): $199

Total Due: $9,446

Keep expenses clearly separated from fees to satisfy client accounting requirements and prevent confusion about your consulting rate.

Payment Information

- Accepted payment methods

- Bank details for wire/ACH

- Payment link for credit card

- Late payment terms

Consultant Invoice Example: Sample Template

[YOUR CONSULTING FIRM NAME]

[Address] | [Phone] | [Email]

INVOICE

Invoice #: 2026-0047

Date: January 15, 2026

Due Date: February 14, 2026

Bill To:

Acme Corporation

Attn: Jennifer Walsh, Finance

123 Business Park Drive

Chicago, IL 60601

Project: Digital Transformation Strategy

Reference: SOW #AC-2026-003

Period: December 1-31, 2025

PROFESSIONAL SERVICES

Phase 2: Assessment and Analysis

- Process mapping workshops (3 sessions, 12 hours)

- Technology stack evaluation

- Stakeholder interview synthesis

- Gap analysis documentation

- Phase 2 interim presentation

Phase 2 Monthly Fee (per SOW): $15,000

EXPENSE REIMBURSEMENT

Travel - Chicago workshops (12/8-12/10): $1,456

Research tools (authorized per SOW): $249

Expenses Subtotal: $1,705

TOTAL DUE: $16,705

Payment Terms: Net 30

PO Number: PO-78234

Payment Methods:

- ACH: [Bank details]

- Wire: [Wire details]

- Credit Card: [Payment link]

Questions? Contact [Your Name] at [Email]Time Tracking Best Practices for Consultants

Even if you bill fixed fees, track your time. Here is why:

Inform future pricing. Understanding actual hours helps you quote accurately on future engagements.

Document your work. Time logs prove what you did if disputes arise.

Satisfy client requirements. Some clients require time documentation regardless of billing model.

Identify scope creep. Tracking time by task reveals when projects exceed estimates.

Time Tracking Tips for Consulting Work

Track contemporaneously. Record time as you work, not from memory at week’s end.

Be specific. “Client work - 4 hours” tells you nothing. “Stakeholder interview prep and facilitation - 4 hours” helps future pricing.

Use project codes. Separate time by client, project, and phase for clear analysis.

Set minimum increments. Most consultants use 15-minute or 6-minute minimums.

Mobile time tracking tools let you capture time between meetings, during travel, or from client sites—wherever your consulting work happens.

Payment Terms and Getting Paid Faster as a Consultant

Standard consulting payment terms:

- Net 30 is most common for corporate clients

- Net 15 works for smaller engagements

- Due on receipt for smaller clients or rush work

For new client relationships, require deposits before starting work. A 25-50% deposit demonstrates client commitment and ensures you are compensated if the engagement derails early.

Tips for Accelerating Consulting Payments

Invoice immediately upon milestone completion. Do not wait until month-end.

Include payment links. Clients who can pay with one click pay faster. Pronto Invoice includes payment links in every invoice, reducing friction between receiving and paying.

Reference the agreement. “Per SOW dated 10/15/2024” reminds clients this is expected, not a surprise.

Send reminders proactively. A polite reminder before the due date prevents most late payments. Our guide on automated invoice reminders covers how to set these up.

Offer multiple payment methods. ACH, wire, credit card—make it easy for client accounting processes.

Frequently Asked Questions About Consulting Invoices

What should a consulting invoice include?

A consulting invoice should include your business information, client details, unique invoice number, invoice date, due date, project reference, itemized services with descriptions, expense reimbursements (if applicable), total amount due, and payment instructions. Reference your SOW or contract number to connect the invoice to agreed terms.

How often should consultants invoice clients?

Invoice frequency depends on your billing model. For hourly work, invoice weekly or bi-weekly to maintain cash flow. For project work, invoice at agreed milestones. For retainers, invoice monthly at the beginning of each service period. The key is to invoice promptly—waiting delays payment.

Should consultants require upfront payment?

Yes, especially for new clients or large engagements. A 25-50% deposit before starting work protects your cash flow and demonstrates client commitment. For ongoing relationships with established payment history, you may reduce or eliminate deposits.

How do I handle scope creep on consulting invoices?

Document scope changes in writing before performing additional work. When invoicing, create a separate line item for the additional work and reference the change order or email approval. This maintains transparency and prevents disputes about unexpected charges.

What billing model is best for consulting work?

It depends on the engagement. Hourly billing works best for undefined scope or advisory work. Project-based fees work for well-defined deliverables. Retainers suit ongoing relationships. Many consultants use hybrid approaches—hourly discovery followed by fixed-fee implementation, or retainers with hourly overage for additional requests.

How do I calculate my consulting rate?

Two common methods: (1) Take your target annual income, divide by billable hours (typically 1,000-1,500), and add 25-50% for overhead. (2) Multiply your previous hourly salary by 3x to account for benefits, taxes, and non-billable time. Research market rates for your specialty and adjust based on your experience and value delivered.

Next Steps for Writing Professional Consulting Invoices

Building professional consulting invoices is straightforward once you have the right structure:

- Choose your billing model based on engagement type

- Document scope clearly with a statement of work before work begins

- Structure milestone payments for longer engagements

- Invoice promptly with value-focused descriptions

- Make payment easy with multiple options and clear instructions

Your expertise deserves professional presentation. Every invoice is an opportunity to reinforce the value you deliver and ensure timely payment for your consulting work.

Ready to create professional consulting invoices in minutes? Try our consulting invoice template or get started with Pronto Invoice and experience the fastest way to bill for your expertise.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.