Invoice Number Best Practices: The Complete Guide for Small Businesses

Master invoice number best practices with our guide to 4 numbering systems. Stay audit-ready and avoid costly mistakes.

You just spent twenty minutes searching through a shoebox of receipts and a messy spreadsheet trying to figure out if invoice “23” was the one you sent to the Henderson kitchen remodel or the emergency plumbing call at the strip mall. Your accountant is on hold. Tax season is breathing down your neck.

This scenario plays out in thousands of small businesses every week—and following invoice number best practices makes it entirely preventable.

A well-designed invoice numbering system does more than keep your paperwork tidy. It protects you during audits, speeds up payment tracking, helps you spot unpaid invoices instantly, and projects professionalism to clients who are deciding whether to hire you again.

This guide covers everything you need to know about invoice number best practices: the four main numbering systems, how to choose the right one for your business, common mistakes to avoid, and how to recover when things go wrong.

Table of Contents

- Why Invoice Numbering Matters for Your Business

- 4 Invoice Numbering Systems Explained

- How to Choose the Right Invoice Numbering System

- Setting Up a Scalable Invoice Number System

- Invoice Numbering Mistakes to Avoid

- How to Fix Invoice Numbering Errors

- Invoice Numbers for Multiple Revenue Streams

- Invoice Number Best Practices FAQ

- Start Your Invoice Numbering System Today

Why Invoice Numbering Matters for Your Business

Invoice numbers are not just administrative busywork. They serve three critical business functions that directly impact your bottom line.

Tax Compliance and Audit Protection

The IRS expects businesses to maintain organized financial records. During an audit, you need to quickly locate any invoice from the past three to seven years. Understanding how long to keep business records is just as important as organizing them. A logical numbering system lets you pull records in minutes instead of hours.

Gaps in sequential numbering can raise red flags—auditors may suspect missing income. According to industry research, approximately 39% of invoices contain errors, making consistent invoice organization essential for compliance.

Payment Tracking and Cash Flow Management

When a client says “I already paid that invoice,” you need to verify instantly. A clear invoice numbering system lets you cross-reference payments, identify outstanding balances, and follow up on overdue accounts without confusion.

Proper invoice tracking can accelerate your payment collection by 30% or more, directly improving cash flow. Pairing a good numbering system with clear payment terms amplifies this effect.

Professional Credibility

Clients notice details. An invoice labeled “Invoice 3” suggests you are new to business (or disorganized). An invoice numbered “2024-0847” communicates that you run a legitimate, established operation. This perception affects everything from payment speed to referral likelihood.

4 Invoice Numbering Systems Explained

Each system has distinct advantages depending on your business type, volume, and organizational preferences. Understanding how to number invoices correctly starts with knowing your options.

Sequential Invoice Numbering

The simplest approach: start at 1 (or 001, or 1001) and count upward.

Format Examples:

- 001, 002, 003…

- INV-0001, INV-0002, INV-0003…

- 1001, 1002, 1003… (starting higher to appear established)

Best For: Businesses with straightforward operations, single service lines, and moderate invoice volume.

Advantages:

- Easy to implement and understand

- Clear chronological order

- Simple gap detection for audits

Disadvantages:

- No context about date, client, or project

- Can reveal business volume to clients (Invoice #12 shows you are new)

- Harder to organize by time period

Date-Based Invoice Numbers

Incorporates the date into the invoice number, making time-period lookups instant.

Format Examples:

- 20241215-001 (YYYYMMDD-sequence)

- 2024-12-015 (YYYY-MM-sequence)

- 1224-03 (MMYY-sequence)

Best For: Businesses that invoice frequently and need quick date-range searches, especially for monthly or quarterly reporting.

Advantages:

- Instantly identifies when invoice was created

- Easy to pull all invoices from a specific month or year

- Resets sequence periodically (reduces number length)

Disadvantages:

- Longer numbers

- Requires discipline to reset sequences correctly

- Can create duplicates if resetting mid-period

Client-Based Invoice Numbering

Builds client identification into the invoice number itself.

Format Examples:

- SMITH-001, SMITH-002 (client name prefix)

- JH-2024-003 (client initials + year + sequence)

- C0042-007 (client ID + sequence)

Best For: Businesses with repeat clients and ongoing relationships—property managers, marketing agencies, IT support providers.

Advantages:

- Instantly see all invoices for a specific client

- Simplifies client-specific reporting

- Helpful for managing retainer relationships

Disadvantages:

- New clients require new prefixes

- Can become unwieldy with many clients

- Requires consistent prefix documentation

Project-Based Invoice Numbers

Ties invoices to specific jobs or projects.

Format Examples:

- HEND-KITCHEN-01 (client + project + sequence)

- PRJ2024-042-INV03 (project ID + invoice sequence)

- 1847-A, 1847-B, 1847-C (job number + invoice letter)

Best For: Contractors, construction companies, and service providers who bill multiple times per project.

Advantages:

- All project invoices grouped together

- Clear connection between work and billing

- Excellent for job costing and profitability analysis

Disadvantages:

- Requires project tracking system first

- Numbers can become long and complex

- Less useful for one-time service calls

How to Choose the Right Invoice Numbering System

Use this decision framework to identify your best fit:

| If You… | Consider This System |

|---|---|

| Send fewer than 50 invoices per year | Sequential |

| Need to quickly find invoices by month | Date-Based |

| Have many repeat clients with ongoing work | Client-Coded |

| Bill multiple times per job or project | Project-Based |

| Have multiple business lines or divisions | Hybrid (prefix + any system) |

Invoice Number Best Practices for Field Service Professionals

Electricians, plumbers, HVAC technicians, and contractors often benefit from a hybrid approach: a service type prefix combined with date-based numbering. Each trade has its own invoicing requirements—see our industry-specific guides for details.

Example: HVAC-2412-003 tells you immediately this is an HVAC job from December 2024, and it is the third HVAC invoice that month.

This approach works especially well when you offer multiple service types and need to track revenue by category.

Setting Up a Scalable Invoice Number System

Your invoicing needs in year five will differ from year one. Build scalability into your system now with these invoice number best practices.

Use Adequate Digit Padding

Start with more digits than you currently need. If you send 20 invoices monthly, use four-digit sequences (0001) rather than two (01). This prevents awkward transitions and maintains sort order in spreadsheets and accounting software.

Document Your System

Write down your numbering rules. This matters when you hire employees, work with bookkeepers, or simply forget your own system six months later.

Address Multi-Device Challenges

If you create invoices from multiple devices or locations—common for field service professionals—you risk duplicate numbers. Two technicians creating “next” invoices simultaneously might both generate invoice 0847.

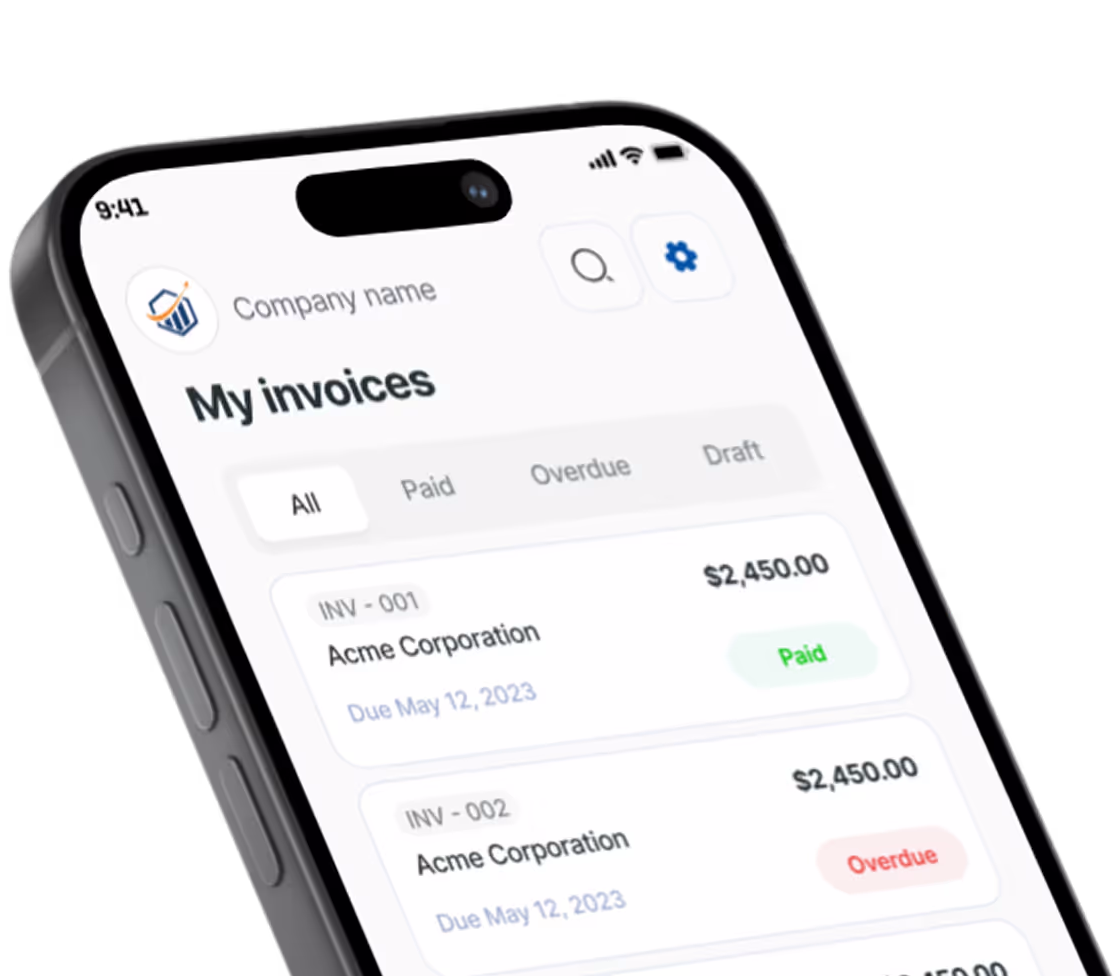

Modern invoicing apps like Pronto Invoice handle this automatically with intelligent numbering that syncs across devices. The system generates unique numbers even when you are offline on a job site, preventing duplicates without manual coordination.

Plan for Business Growth

If you might add partners, locations, or service lines, build in prefix capacity now. Starting with structure like [Location]-[Year]-[Sequence] lets you expand without rebuilding your entire system.

Invoice Numbering Mistakes to Avoid

Following invoice number best practices means knowing what not to do. Here are the most common errors that cause problems.

Starting at Invoice #1

New businesses often start at one, which signals inexperience to clients. Begin at 100, 500, or 1000 instead. This is standard business practice that avoids unnecessary questions about your experience level.

Using Inconsistent Formats

Mixing formats (sometimes “INV-001,” sometimes “Invoice 1,” sometimes just “1”) creates chaos in spreadsheets and accounting software. Pick one format and enforce it rigidly.

Leaving Gaps Without Documentation

If you void an invoice, document why. Unexplained gaps in sequential numbering raise audit concerns. Keep a simple log: “Invoice 0234 voided - duplicate entry, see Invoice 0235.”

Manual Numbering Across Multiple Devices

Tracking the “next number” manually works until it does not. The moment you create invoices from your phone, tablet, and laptop—or have multiple team members invoicing—conflicts become inevitable.

Reusing Numbers After Voids

Never reuse a voided invoice number. Even if Invoice 0234 was a mistake, the next invoice should be 0235. Reusing numbers creates accounting nightmares and audit problems.

How to Fix Invoice Numbering Errors

Already have a messy system? Here is how to clean it up and implement proper invoice organization.

Option 1: The Clean Break

Choose a date (January 1 works well) and start fresh with a new system. Document that invoices before that date follow the old system. This is usually the simplest solution.

Option 2: The Prefix Reset

Add a new prefix to your existing sequence. If your old invoices were 001-427, start new invoices at A-001 or 2025-001. This preserves history while establishing new order.

Option 3: The Full Audit

For serious problems, export all invoices to a spreadsheet, assign new numbers following your chosen system, and update your accounting records. Time-consuming but sometimes necessary.

Whichever approach you choose, document the transition. A simple note explaining your numbering history prevents confusion during future audits or bookkeeper handoffs.

Invoice Numbers for Multiple Revenue Streams

Businesses with distinct service lines face unique numbering challenges. A contractor who does both residential remodels and commercial maintenance needs to track these separately for profitability analysis and tax purposes.

Recommended Approach: Division Prefixes

Assign each revenue stream a prefix:

- RES-2024-001 (Residential)

- COM-2024-001 (Commercial)

- MAINT-2024-001 (Maintenance contracts)

This keeps sequences manageable while enabling instant categorization.

Integration with Accounting Software

Your numbering system should align with how you categorize income in QuickBooks or your accounting platform. Invoice prefixes that match your chart of accounts categories simplify reconciliation significantly.

Pronto Invoice offers QuickBooks integration that syncs invoice numbers and categories automatically, eliminating manual data entry and reducing categorization errors.

Invoice Number Best Practices FAQ

What is the best invoice numbering format?

The best format depends on your business. Sequential numbering (001, 002, 003) works for simple operations with low volume. Date-based numbering (2025-01-001) suits high-volume businesses needing quick time-period searches. Client-coded systems work best for businesses with repeat clients and ongoing relationships.

Should I start invoice numbers at 1?

No. Starting at 1 signals you are new to business and may reduce client confidence. Begin at 100, 500, or 1000 to project professionalism and avoid unnecessary questions.

What happens if I skip an invoice number?

Skipping numbers can raise audit concerns. Document why gaps exist (voided invoice, system error) in a simple log. Continue with the next number in sequence—never reuse skipped numbers.

Can I change my invoice numbering system?

Yes. Choose a transition date, add a new prefix to distinguish new invoices from old ones, and document the change for your records and accountant. The clean break method works best for most businesses.

Are invoice numbers legally required?

In the US, the IRS does not mandate a specific numbering format, but organized records are expected. Invoice numbers help prove income, prevent duplicate billing claims, and protect you during audits. Some countries have stricter requirements for sequential numbering.

How many digits should invoice numbers have?

Use more digits than you currently need to allow for growth. If you send 20 invoices monthly, start with four digits (0001). This prevents awkward transitions later and maintains proper sorting in spreadsheets.

Start Your Invoice Numbering System Today

Implementing invoice number best practices takes thirty minutes now but saves dozens of hours over the life of your business. Here is your action plan:

Assess your current situation. How many invoices do you send monthly? Do you have repeat clients? Multiple service lines? Multiple people or devices creating invoices?

Choose your system using the decision framework above. When in doubt, date-based numbering with a service prefix offers the best balance of simplicity and utility.

Document your format in a simple one-page reference. Include examples and rules for edge cases.

Implement with proper tools. Manual numbering across devices and team members creates inevitable conflicts. Invoicing software that handles numbering automatically—like Pronto Invoice’s intelligent system that prevents duplicates even offline—removes this entire category of potential problems.

Set a transition date if you are cleaning up an existing mess. Communicate the change to your bookkeeper or accountant.

Your invoice numbers are the backbone of your financial record-keeping. A logical, consistent system protects you during audits, accelerates payment tracking, and projects the professionalism your business deserves. Combine it with proper invoice formatting and a professional invoicing workflow to maximize your chances of getting paid on time.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.