Landscaping Invoice Requirements: Complete Guide to Billing for Projects and Maintenance

Learn landscaping invoice requirements for projects, maintenance contracts, and seasonal billing with templates.

You finished a long day of spring cleanups—ten properties, countless bags of debris, equipment repairs between jobs. Now it is 7 PM, you are exhausted, and you still have invoices to create. Some clients pay per visit. Others have seasonal contracts. One customer wants materials itemized separately from labor. Another insists on before-and-after photos with every bill.

This invoicing complexity is why many landscaping businesses leave thousands of dollars uncollected each year. The seasonal nature of the work, combined with varying service types and client expectations, creates billing challenges that generic invoicing approaches simply cannot solve.

This guide covers everything you need to know about landscaping invoice requirements—from structuring one-time project bills to automating recurring maintenance contracts. Whether you are mowing residential lawns or managing commercial grounds maintenance, you will find actionable strategies to bill faster, get paid sooner, and spend less time on paperwork.

What You Will Learn

- Essential Elements of a Landscaping Invoice

- Legal Requirements for Landscaping Invoices

- Invoicing for One-Time Landscaping Projects

- Setting Up Recurring Billing for Maintenance Contracts

- Seasonal Billing Strategies

- Material vs Labor Breakdown Best Practices

- Property-Specific Pricing Documentation

- Before and After Documentation for Invoices

- Common Landscaping Invoice Mistakes to Avoid

Essential Elements of a Landscaping Invoice

Every landscaping invoice needs certain core elements to be professional, legally compliant, and clear to your clients. Missing any of these landscaping invoice requirements can delay payment or create disputes.

Business Information Requirements

Company Details:

- Company name and logo

- Physical address

- Phone number and email

- Contractor license number (required in many states for landscape contractors)

- Insurance policy reference (commercial clients often require proof of coverage)

Client Information:

- Client name or company

- Service address (critical when billing address differs from job site)

- Billing address if different

- Contact person for commercial accounts

Invoice Documentation Requirements

Transaction Details:

- Unique invoice number (e.g., INV-1001, INV-1002)

- Invoice issue date

- Service date(s) performed

- Payment terms and due date

- Itemized services with quantities and unit prices

- Materials used with individual costs

- Subtotal, applicable taxes, and total due

- Accepted payment methods

For landscaping specifically, always include the property address on every invoice—even if it matches the billing address. This becomes essential when you service multiple properties for the same client, a common scenario with property management companies.

Understanding proper invoice formatting principles ensures your landscaping invoices meet professional standards while addressing industry-specific requirements.

Legal Requirements for Landscaping Invoices

Landscaping invoice requirements vary by state and project type. Understanding these legal obligations protects your business and ensures compliance.

State Licensing Documentation

In 32 states, basic lawn care services like mowing and cleanup only require a standard business license. However, landscaping work involving installation, construction, or property modification often triggers additional licensing requirements.

Examples of state-specific requirements:

- California: Requires C-27 Landscaping Contractor license for installation projects, plus $1 million minimum general liability insurance

- Arizona: C-21 license required for projects over $1,000 involving irrigation or hardscaping

- Texas: No statewide license required, but local municipalities may require business permits

Your invoice should display your contractor license number when required by your state. Commercial clients frequently verify this information before processing payment.

Tax Collection Requirements

Tax requirements for landscaping invoices differ based on your location and service type:

- Labor-only services: Often exempt from sales tax in many states

- Materials: Typically taxable—must be itemized separately

- Combined services: May require proportional tax calculation

Always separate materials from labor on your landscaping invoice to ensure accurate tax collection and remittance.

Insurance Documentation

Commercial clients increasingly require proof of insurance before approving invoices. Include your policy number on invoices or attach certificates of insurance for:

- General liability coverage

- Workers’ compensation (if you have employees)

- Commercial auto insurance

Invoicing for One-Time Landscaping Projects

One-time projects—new installations, hardscape work, major renovations—require detailed invoicing that protects both you and your client. Meeting landscaping invoice requirements for large projects means documenting every phase of work.

Project Invoice Structure

For installation and renovation projects, break your invoice into clear categories:

Example: Patio Installation Invoice

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Labor | |||

| Site preparation and grading | 8 hours | $65/hr | $520 |

| Paver installation | 16 hours | $75/hr | $1,200 |

| Edging and finishing | 4 hours | $65/hr | $260 |

| Materials | |||

| Concrete pavers (Cambridge) | 320 sq ft | $4.50/sq ft | $1,440 |

| Polymeric sand | 6 bags | $28/bag | $168 |

| Crushed stone base | 4 tons | $45/ton | $180 |

| Landscape fabric | 350 sq ft | $0.35/sq ft | $122.50 |

| Edge restraint | 85 linear ft | $2.10/lf | $178.50 |

| Equipment | |||

| Plate compactor rental | 2 days | $85/day | $170 |

| Delivery fee | 1 | $150 | $150 |

| Subtotal | $4,389 | ||

| Tax (materials only) | $188.74 | ||

| Total Due | $4,577.74 |

Progress Billing for Large Projects

For projects exceeding $2,500, consider progress billing to maintain cash flow:

- Deposit: 25-50% before work begins (covers initial material costs)

- Progress payment: 25-35% at project midpoint

- Final payment: Remaining balance upon completion

Include your payment schedule in your initial quote or proposal so clients understand expectations before work begins.

Setting Up Recurring Billing for Maintenance Contracts

Recurring maintenance contracts are the backbone of a profitable landscaping business. They provide predictable revenue and reduce the feast-or-famine cycle that plagues seasonal operations. Proper landscaping invoice requirements for recurring services differ from one-time project billing.

Maintenance Contract Billing Models

Per-Visit Billing: Invoice after each service. Best for clients who want flexibility or variable service frequencies.

Monthly Fixed Rate: Charge the same amount each month regardless of visit frequency. Calculate your annual service cost and divide by 12. This smooths cash flow for both you and your client.

Seasonal Contracts: Bill for a defined season (April-October, for example) either upfront, monthly, or in two installments.

Automating Recurring Lawn Care Invoices

Manual recurring billing is where most landscapers lose time and money. Invoices get delayed, amounts vary when they should not, and clients slip through the cracks.

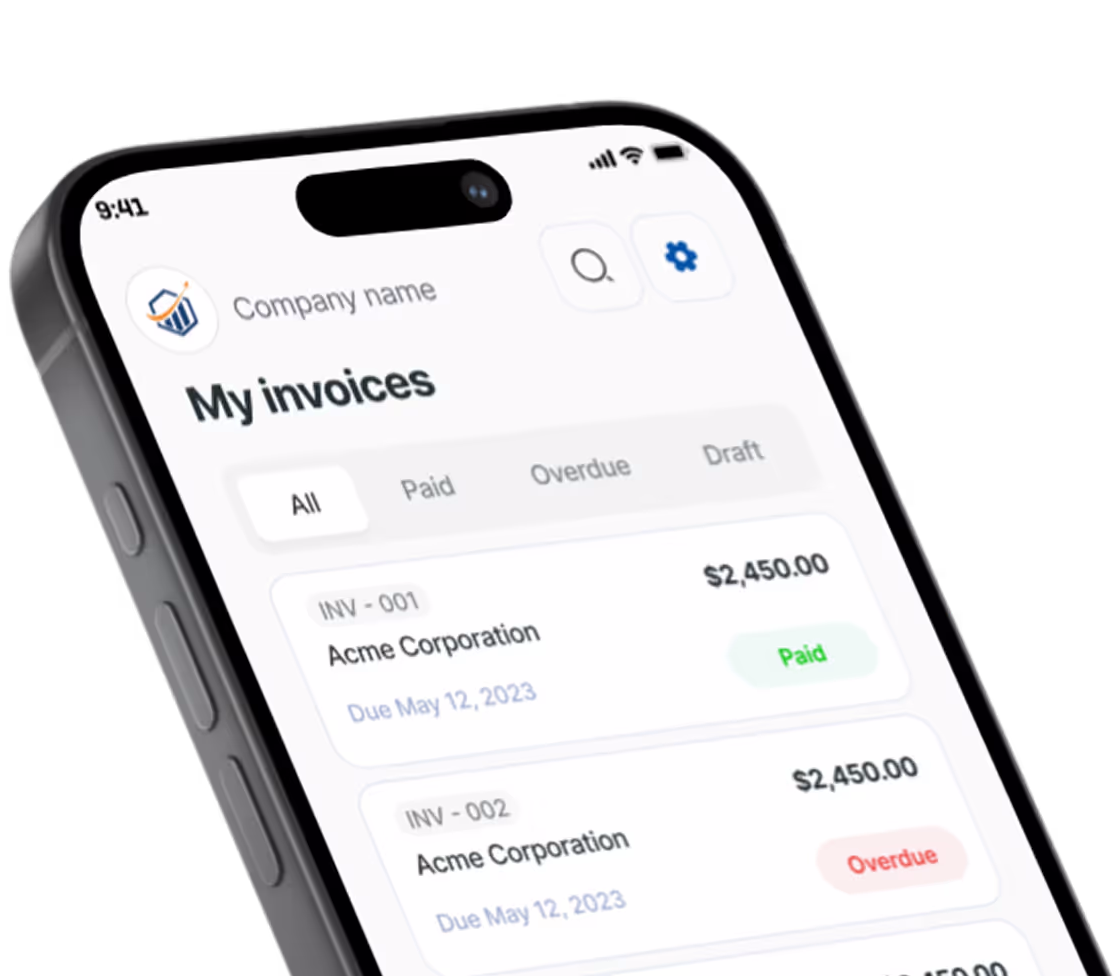

Modern invoicing solutions with recurring invoice features like Pronto Invoice let you set up recurring invoices once and automate the entire process. Define the service, frequency, and amount—the invoice generates and sends automatically on schedule. For a landscaper managing 50 weekly maintenance clients, this automation saves roughly 8-10 hours monthly on billing alone.

Sample Recurring Invoice Line Items

Weekly Lawn Maintenance Contract:

| Service | Frequency | Monthly Rate |

|---|---|---|

| Mowing (up to 10,000 sq ft) | Weekly | $200 |

| Edging and trimming | Weekly | Included |

| Blowing walkways/driveway | Weekly | Included |

| Weed control (beds) | Bi-weekly | $40 |

| Monthly Total | $240 |

Seasonal Billing Strategies

Landscaping revenue fluctuates dramatically by season. Your landscaping billing approach should account for this reality with season-specific invoicing strategies.

Spring Billing (March-May)

Spring brings your highest-volume billing period. Services to invoice separately:

- Spring cleanup (leaf removal, bed preparation, debris clearing)

- Mulch installation (always itemize material and labor separately)

- Lawn dethatching and aeration

- Pruning and trimming

- Fertilization program initiation

Billing tip: For spring cleanup, quote by property complexity rather than hourly. Properties vary wildly—a corner lot with mature oaks requires far more work than a newer subdivision property. Your landscaping invoice should reflect the actual scope, not just hours worked.

Summer Billing (June-August)

Peak maintenance season. Most billing should be recurring, but invoice these add-on services separately:

- Additional mowing due to rapid growth

- Irrigation repairs and adjustments

- Pest and disease treatments

- Deadheading and summer pruning

Fall Billing (September-November)

Fall cleanup billing often exceeds spring in total revenue:

- Leaf removal (consider per-visit vs. seasonal flat rate)

- Gutter cleaning (if offered)

- Fall aeration and overseeding

- Perennial cutback

- Winterization of irrigation systems

- Final fertilizer application

Billing tip: For leaf removal, consider offering a seasonal flat rate rather than per-visit billing. This protects your revenue if early snowfall cuts the season short and gives clients predictable costs.

Winter Billing (December-February)

Even in cold climates, winter billing opportunities exist:

- Snow removal contracts (per-push, per-inch, or seasonal)

- Ice management services

- Holiday lighting installation/removal

- Winter pruning of dormant trees

- Deposit invoices for spring equipment

For snow contracts specifically, clarify your payment terms upfront. Net-15 or payment-upon-service terms prevent cash flow gaps during peak winter operations.

Material vs Labor Breakdown Best Practices

Separating materials from labor is a critical landscaping invoice requirement that affects your taxes, client trust, and dispute resolution.

Why Separate Materials and Labor

Tax compliance: Many states tax materials but not labor. Failing to separate them can mean over-collecting (and remitting) sales tax or facing audit penalties.

Transparency builds trust: Clients can see exactly what they are paying for. This reduces disputes and builds long-term relationships.

Markup clarity: Industry standard markup on materials is 15-25%. When separated, this markup is easier to justify and apply consistently.

Change order accuracy: When project scope changes, you can quickly calculate the cost difference.

Material Markup Strategies for Landscaping Invoices

| Material Type | Typical Markup | Justification |

|---|---|---|

| Plants and trees | 25-35% | Mortality risk, transport care, warranty |

| Hardscape materials | 15-20% | Ordering, delivery coordination |

| Mulch and soil | 20-25% | Storage, delivery, waste factor |

| Chemicals and fertilizers | 15-20% | Licensing, storage requirements |

Always maintain receipts for materials. If a client questions pricing, you can demonstrate your actual costs and reasonable markup.

Property-Specific Pricing Documentation

Not all properties are created equal. A 10,000 square foot lawn on flat terrain takes half the time of a 10,000 square foot lawn with slopes, obstacles, and limited access. Your landscaping invoice requirements should include property-specific documentation.

Factors to Document Per Property

- Lot size: Actual maintained square footage

- Terrain: Flat, sloped, multi-level

- Obstacles: Trees, beds, play equipment, pools

- Access: Gate codes, equipment limitations, parking restrictions

- Special requirements: Organic-only products, pet considerations, noise restrictions

- Service notes: Preferred day/time, contact protocol

When you document these details, you can justify different pricing for similar-sized properties. Your invoice can reference specific conditions when a client questions why their neighbor pays less.

Pronto Invoice allows you to store property notes with each client profile. When creating invoices on-site—even without cell signal—you have all relevant property details at hand.

Before and After Documentation for Invoices

Visual documentation serves multiple purposes: it proves work completion, markets your services, and protects against payment disputes. Including photo documentation meets modern landscaping invoice requirements for transparency.

What to Photograph

Before every service:

- Overall property view from multiple angles

- Specific problem areas requiring attention

- Any pre-existing damage (protect yourself from blame)

After every service:

- Same angles as before photos for direct comparison

- Detail shots of completed work

- Any areas of concern you want documented

Integrating Photos with Landscaping Invoices

Many landscapers take photos but never connect them to billing. This is a missed opportunity. When you attach before-and-after photos to your invoice:

- Clients are reminded of the value you provided

- Payment disputes decrease significantly

- You build a portfolio for marketing future services

Mobile-first invoicing apps let you capture photos on-site and attach them directly to invoices. No more returning to the office to match photos with paperwork.

Common Landscaping Invoice Mistakes to Avoid

After reviewing thousands of landscaping invoices, these errors appear most frequently and violate basic landscaping invoice requirements:

1. Vague service descriptions “Lawn service - $150” tells the client nothing. Itemize each task performed with specific descriptions.

2. Missing service dates Especially problematic for recurring services. Always include the specific date(s) work was performed.

3. No property address When clients have multiple properties, unclear invoices create confusion and payment delays.

4. Inconsistent pricing If the same service costs different amounts without explanation, clients lose trust. Document your property-specific pricing logic.

5. Delayed invoicing Invoices sent weeks after service completion have significantly lower collection rates. The same principles that apply to HVAC invoicing hold true for landscaping: invoice immediately upon service completion.

6. No payment terms If you do not specify when payment is due, clients will pay on their own timeline—often 60-90 days. Include clear due dates and late fee policies.

7. Missing license or insurance information Commercial clients may reject invoices that lack required contractor credentials.

Streamline Your Landscaping Invoicing

Landscaping invoicing does not have to consume your evenings and weekends. The key is building systems that match how you actually work—in the field, often with dirty hands, frequently without reliable cell signal.

Start by auditing your current invoicing against these landscaping invoice requirements:

- How long does it take to create a typical invoice?

- How many recurring clients could benefit from automated billing?

- Are you consistently documenting materials separately from labor?

- Do your invoices include all required elements for your state?

- Are you attaching photo documentation to justify completed work?

Modern invoicing tools designed for field service professionals—like Pronto Invoice—address these specific challenges. Create invoices on your phone between jobs, set up recurring billing for maintenance contracts once, and attach property photos directly to each invoice. The goal is invoicing that takes seconds, not hours.

Your expertise is in creating beautiful landscapes and maintaining healthy properties. With the right invoicing system, you can focus on that expertise while getting paid faster and more consistently than ever before. Try our landscaping invoice template to get started.

Frequently Asked Questions About Landscaping Invoice Requirements

What information is legally required on a landscaping invoice? At minimum, include your business name and contact information, client details, unique invoice number, service dates, itemized services and costs, tax amounts, total due, and payment terms. Many states also require contractor license numbers for landscaping work.

How should I handle sales tax on landscaping invoices? Separate materials from labor on every invoice. Most states tax materials but exempt labor. This separation ensures accurate tax collection and protects you during audits.

When should I send landscaping invoices? Send invoices within 48 hours of completing work. Immediate invoicing increases collection rates and keeps your cash flow healthy. For recurring maintenance, set up automated billing on a consistent schedule.

What payment terms work best for landscaping businesses? Net-15 to Net-30 terms are standard for residential clients. For larger projects, use progress billing with deposits. Commercial clients may require Net-30 but often pay faster with early payment discounts.

How do I invoice for seasonal landscaping contracts? Calculate total annual service value, then offer monthly billing (divide by 12), seasonal billing (divide by active months), or upfront payment with a discount. Document the billing schedule in your service agreement.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.