Profitability Ratios for Small Business: 4 Formulas That Reveal Your True Earnings

Calculate the 4 essential profitability ratios for small business. Formulas, benchmarks, and tips to boost margins.

You finished a busy month. Invoices went out. Payments came in. But when you check your bank account, the number feels wrong. Where did all that revenue go?

This disconnect between revenue and actual profit is the silent killer of small businesses. The solution is not working more hours or raising prices blindly. It is understanding your profitability ratios for small business — the handful of numbers that reveal whether your business is actually making money.

Whether you are a plumber, electrician, freelance consultant, or any other small business owner, these small business financial ratios give you clarity that raw dollar amounts never will.

This guide breaks down the four profitability ratios that matter most, shows you exactly how to calculate them, and gives you concrete benchmarks to measure against. No accounting degree required.

Table of Contents

- What Are Profitability Ratios and Why Do They Matter?

- Gross Profit Margin: Your Pricing Health Check

- Net Profit Margin: The Bottom Line That Matters

- Overhead Ratio: Where Is Money Leaking Out?

- Labor Efficiency Ratio: Are You Maximizing Billable Time?

- Profitability Ratios Comparison: Which Metric to Prioritize

- How to Track Profitability Ratios Consistently

- Taking Action on Your Profitability Numbers

- Frequently Asked Questions

What Are Profitability Ratios and Why Do They Matter?

Profitability ratios are financial metrics that show how effectively your business converts revenue into profit. Unlike raw dollar amounts, ratios give you percentages that you can compare across time periods, against competitors, and to industry benchmarks.

For small businesses, profitability ratios answer four critical questions:

- Am I pricing correctly? (Gross Profit Margin)

- Is my business sustainable? (Net Profit Margin)

- Where is money leaking out? (Overhead Ratio)

- Am I using my time wisely? (Labor Efficiency Ratio)

These small business financial ratios also matter when you need financing. Lenders and investors evaluate profitability ratios to assess risk before approving loans or making investment decisions. Strong ratios make your business a more attractive borrower with access to better terms.

The best part: you already have the data you need. Your invoices, expenses, and time logs contain everything required to calculate these ratios. The challenge is organizing that information and knowing what the numbers mean.

Gross Profit Margin: Your Pricing Health Check

Gross profit margin measures how much money remains after paying for the direct costs of delivering your service or product. This is your first indicator of pricing health and one of the most important profitability ratios for small business owners to track.

How to Calculate Gross Profit Margin

Formula:

Gross Profit Margin = ((Revenue - Cost of Goods Sold) / Revenue) x 100Example: An electrical contractor completes a panel upgrade job.

- Total invoice amount: $2,400

- Direct costs (parts, materials, subcontractor): $800

- Gross Profit: $2,400 - $800 = $1,600

- Gross Profit Margin: ($1,600 / $2,400) x 100 = 66.7%

For every dollar billed, 67 cents remains after covering direct job costs.

Industry Benchmarks for Gross Profit Margin

| Industry | Target Gross Margin |

|---|---|

| Plumbing/HVAC | 50-65% |

| Electrical contractors | 55-70% |

| Landscaping | 45-55% |

| Photography/Video | 70-85% |

| Graphic design | 75-90% |

| Consulting | 80-95% |

| General contracting | 35-45% |

According to NYU Stern School of Business data, gross margins vary significantly by industry. The key is comparing your numbers to businesses similar to yours, not to unrelated industries.

How to Improve Your Gross Profit Margin

1. Audit your material costs. Are you getting supplier discounts? Buying in bulk where it makes sense? A 10% reduction in material costs directly increases your margin.

2. Track actual vs. estimated costs per job. If you consistently underestimate material needs, your margin suffers. Reviewing past invoices against actual business overhead expenses reveals patterns.

3. Adjust pricing on low-margin services. Some jobs simply do not pay. Identify services where your gross margin falls below 40% and either raise prices or stop offering them. When deciding between flat rate vs. hourly pricing, consider which model delivers better margins for each service type.

4. Reduce waste and rework. Every callback, every wasted material, and every mistake chips away at gross profit. Document issues to find patterns.

Net Profit Margin: The Bottom Line That Matters

While gross margin shows job-level profitability, net profit margin reveals whether your entire business model works. This number accounts for all expenses — rent, insurance, marketing, software, vehicle costs, everything. It is the most comprehensive of all profitability ratios for small business analysis.

How to Calculate Net Profit Margin

Formula:

Net Profit Margin = (Net Income / Total Revenue) x 100Where Net Income = Total Revenue - All Expenses (including direct costs, overhead, taxes)

Example: A freelance photographer’s quarterly numbers.

- Total revenue (invoiced): $45,000

- Cost of goods sold (prints, albums, second shooter): $8,000

- Operating expenses (software, insurance, marketing, equipment): $12,000

- Net Income: $45,000 - $8,000 - $12,000 = $25,000

- Net Profit Margin: ($25,000 / $45,000) x 100 = 55.6%

Industry Benchmarks for Net Profit Margin

| Industry | Healthy Net Margin |

|---|---|

| Field service businesses | 10-20% |

| Creative freelancers | 25-45% |

| Consulting | 30-50% |

| Retail/product-based | 5-15% |

| Professional services | 15-25% |

As a general rule: a net profit margin of 20% or higher is excellent, 10% is average, and anything below 5% is a red flag that requires immediate attention.

Critical threshold: If your net profit margin falls below 10%, your business is vulnerable. One bad month, one major expense, or one slow season could push you into the red.

How to Improve Your Net Profit Margin

1. Review fixed expenses quarterly. Subscriptions, memberships, and recurring costs accumulate silently. Cancel anything you have not used in 90 days. A proper chart of accounts helps you categorize and identify unnecessary spending.

2. Increase prices strategically. A 10% price increase with no additional costs flows directly to your bottom line. Most small businesses underprice their expertise.

3. Improve collection speed. Money stuck in unpaid invoices is not profit — it is accounts receivable. Faster payments mean better cash flow and fewer write-offs. Setting clear invoice payment terms and using strategies to get customers to pay faster directly improves your net margin.

4. Analyze profitability by service type. Not all revenue is equal. Break down your net margin by service category to identify which offerings actually make money.

Overhead Ratio: Where Is Money Leaking Out?

Overhead ratio shows what percentage of revenue goes to running your business rather than delivering services. High overhead means you need more revenue just to break even. Tracking this ratio helps you identify business overhead expenses that silently eat into your profit.

How to Calculate Overhead Ratio

Formula:

Overhead Ratio = (Total Overhead Costs / Total Revenue) x 100Overhead includes: rent, utilities, insurance, administrative salaries, software subscriptions, vehicle expenses (non-job-specific), marketing, professional fees, office supplies.

Example: A small plumbing company’s monthly analysis.

- Monthly revenue: $65,000

- Overhead costs:

- Office rent: $1,800

- Insurance: $900

- Vehicle costs: $1,200

- Software/tools: $400

- Marketing: $800

- Utilities: $300

- Total overhead: $5,400

- Overhead Ratio: ($5,400 / $65,000) x 100 = 8.3%

Industry Benchmarks for Overhead Ratio

| Business Type | Target Overhead Ratio |

|---|---|

| Solo service provider | 5-15% |

| Small team (2-5 people) | 15-25% |

| Growing company (6-10) | 20-30% |

| Established small business | 25-35% |

How to Lower Your Overhead Ratio

1. Negotiate recurring expenses. Insurance, software, and service contracts are often negotiable. Ask for annual payment discounts or loyalty pricing.

2. Eliminate redundant tools. Many small businesses pay for multiple software solutions that overlap. Consolidate where possible. For example, an invoicing tool that also tracks expenses and generates financial reports reduces the need for separate accounting software.

3. Consider revenue increase, not just cost cutting. Growing revenue with the same overhead naturally improves your ratio. Sometimes the better path is more sales, not fewer expenses.

4. Track overhead as a percentage, not just dollars. A $500 monthly expense matters more at $10,000 revenue than at $50,000. Think in percentages. Choosing the right business structure can also affect your overhead through tax implications and legal requirements.

Labor Efficiency Ratio: Are You Maximizing Billable Time?

For service businesses where time equals money, labor efficiency ratio reveals how productively you convert work hours into revenue. This is especially critical for contractors, HVAC technicians, and freelancers who bill by the hour or per job.

How to Calculate Labor Efficiency Ratio

Formula:

Labor Efficiency Ratio = Revenue / Total Labor HoursOr as a percentage:

Billable Efficiency = (Billable Hours / Total Work Hours) x 100Example: An HVAC technician’s weekly productivity.

- Weekly revenue from completed jobs: $4,800

- Total hours worked: 45

- Billable hours (on job sites): 32

- Revenue per hour: $4,800 / 45 = $106.67/hour

- Billable efficiency: (32 / 45) x 100 = 71%

Industry Benchmarks for Labor Efficiency

| Role | Target Billable Efficiency |

|---|---|

| Solo contractor | 60-75% |

| Freelancer | 50-65% |

| Service technician | 70-85% |

| Consultant | 55-70% |

Non-billable time includes: driving between jobs, administrative work, invoicing, marketing, training, waiting for parts or clients.

How to Improve Your Labor Efficiency Ratio

1. Reduce administrative time. Every hour spent on invoicing, scheduling, or bookkeeping is an hour not spent on billable work. Automate where possible.

2. Optimize routing and scheduling. Group jobs by location. Avoid unnecessary trips. Smart scheduling can add hours of productive time weekly.

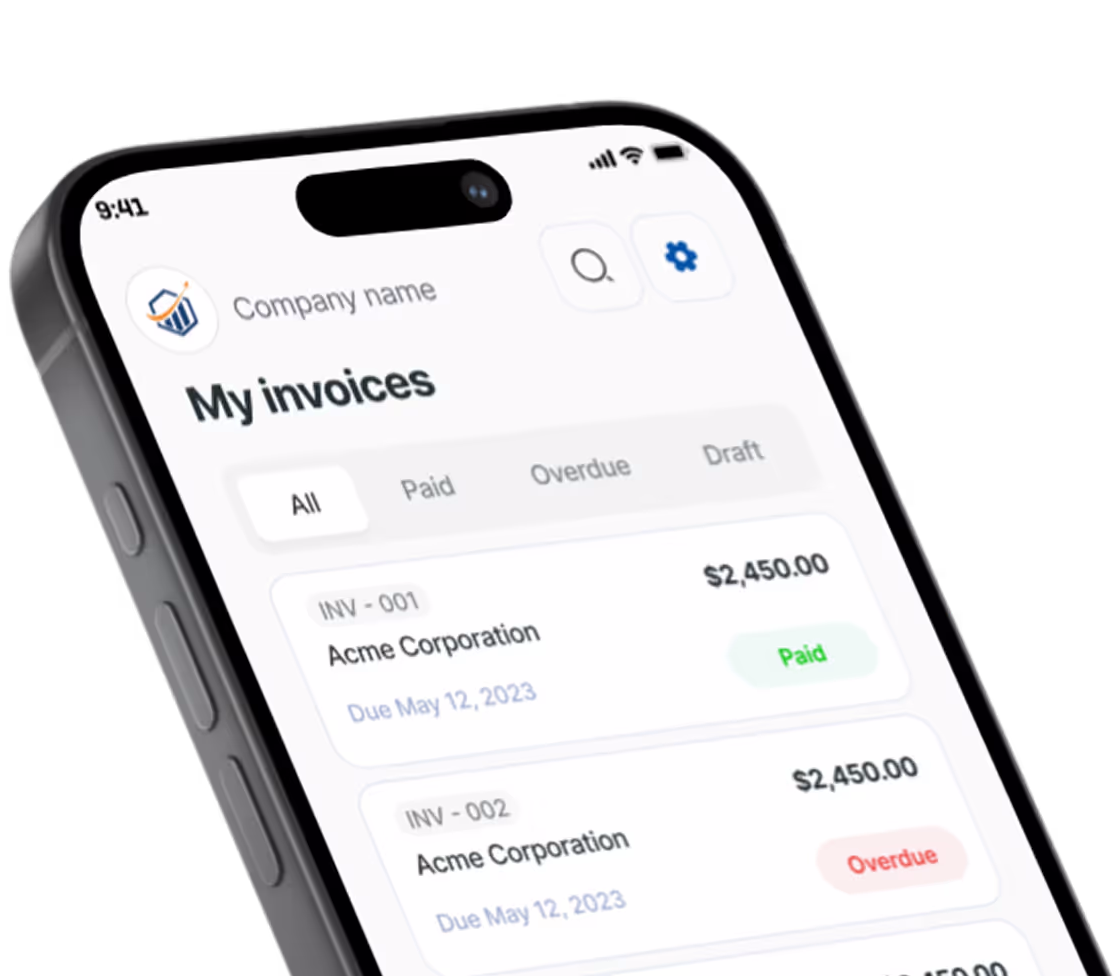

3. Streamline invoicing. Creating invoices should take seconds, not minutes. Mobile invoicing tools like Pronto Invoice let you bill immediately after completing work on the job site — rather than spending evenings on paperwork.

4. Track your time honestly. You cannot improve what you do not measure. Log actual time by activity for at least two weeks to establish your baseline.

Profitability Ratios Comparison: Which Metric to Prioritize

Not all profitability ratios serve the same purpose. Here is a side-by-side comparison to help you decide which small business financial ratios to focus on first.

| Ratio | What It Measures | Best For | Frequency | Priority |

|---|---|---|---|---|

| Gross Profit Margin | Pricing effectiveness | Job-level decisions | Per job + monthly | Start here |

| Net Profit Margin | Overall business health | Strategic planning | Monthly + quarterly | Essential |

| Overhead Ratio | Operational efficiency | Cost management | Monthly | High |

| Labor Efficiency Ratio | Time productivity | Scheduling optimization | Weekly | High (service businesses) |

| Operating Profit Margin | Core operations profit | Isolating operational issues | Monthly | Supplementary |

| Return on Assets (ROA) | Asset utilization | Equipment-heavy businesses | Quarterly | Supplementary |

For field service professionals: Start with gross profit margin per job and labor efficiency ratio. These two metrics have the most immediate impact on your daily revenue.

For freelancers and consultants: Focus on net profit margin and billable efficiency. Since your overhead is typically low, the biggest lever is maximizing the hours you spend on revenue-generating work.

For small businesses with employees: Prioritize overhead ratio and net profit margin. Managing fixed costs while growing revenue is the fastest path to sustainable profitability.

How to Track Profitability Ratios Consistently

Knowing these formulas means nothing if you do not calculate them regularly. Here is a practical system for tracking your profitability ratios for small business success.

Monthly Tracking Checklist

Export your invoice data. Your invoicing system should provide reports showing total revenue, payments received, and outstanding invoices.

Categorize your expenses. Separate direct costs (tied to specific jobs) from overhead (general business expenses). A well-organized chart of accounts makes this step straightforward.

Calculate each ratio. Use a simple spreadsheet or financial dashboard. Track trends over time, not just single snapshots.

Compare to benchmarks. Are you above or below industry averages? Are you improving or declining?

The Invoicing Connection

Your invoice data is the foundation of profitability analysis. Every invoice should capture:

- Service category (to analyze margin by service type)

- Labor hours (to calculate efficiency ratios)

- Materials/costs (to determine gross margin per job)

- Payment date (to track collection speed)

Invoicing tools that categorize services and track job details automatically generate the data you need for ratio analysis. Rather than reconstructing information at month-end, the reports build themselves from your daily invoicing activity.

Pronto Invoice, for example, organizes your invoice data in ways that feed directly into profitability tracking — categorizing by service type, linking to expenses, and providing the revenue reports that make ratio calculation straightforward. You can create a detailed invoice in under 60 seconds from your phone, ensuring every job is documented while the details are fresh.

Taking Action on Your Profitability Numbers

Understanding profitability ratios for small business is only valuable if you act on the insights. Here is a practical framework:

Weekly: Monitor Revenue Trends

- Review invoiced amounts

- Check payment collection status

- Note any unusual patterns

Monthly: Calculate Core Ratios

- Gross profit margin

- Net profit margin

- Overhead ratio

- Revenue per hour

Quarterly: Strategic Analysis

- Compare ratios to previous quarters

- Identify your most and least profitable services

- Adjust pricing or service mix based on data

- Set improvement targets for next quarter

The Compound Effect of Small Improvements

Small improvements compound dramatically. Consider this:

- 5% improvement in gross margin

- 3% reduction in overhead

- 10% improvement in billable efficiency

Combined, these modest gains can increase net profit by 20-30% without adding a single new customer. That is the power of tracking your profitability ratios for small business growth.

Your Next Step

Start with one ratio. Calculate your gross profit margin on the last 10 invoices you sent. If you do not have the data organized to do that calculation in under 5 minutes, that is your first problem to solve.

Clean data from consistent invoicing practices makes profitability analysis possible. Poor data makes it guesswork.

Ready to get organized? Pronto Invoice gives you the structured invoice data, expense tracking, and financial reports you need to calculate these ratios without a spreadsheet headache. Start your free trial and know your numbers in minutes.

Frequently Asked Questions

What is a good profit margin for a small business?

A good net profit margin for a small business typically falls between 10% and 20%. A margin of 20% or higher is considered excellent, 10% is average, and anything below 5% signals potential trouble. However, benchmarks vary by industry — field service businesses average 10-20%, while creative freelancers often achieve 25-45%. The most important thing is tracking your margin over time and improving it consistently.

What are the 4 most important profitability ratios for small business?

The four most important profitability ratios for small business owners are: (1) Gross profit margin, which shows whether your pricing covers direct costs; (2) Net profit margin, which reveals your true bottom-line profitability after all expenses; (3) Overhead ratio, which identifies how much revenue goes to running the business versus generating income; and (4) Labor efficiency ratio, which measures how productively you convert working hours into revenue.

How often should I calculate my profitability ratios?

Calculate your core profitability ratios monthly at minimum. For gross profit margin, track it per job if possible so you can spot underpriced services immediately. Review overhead ratio monthly to catch cost creep early. Perform a comprehensive ratio analysis quarterly to guide strategic pricing and service decisions. Weekly monitoring of billable efficiency is recommended for service-based businesses.

What is the difference between gross profit margin and net profit margin?

Gross profit margin measures the percentage of revenue remaining after subtracting only direct costs (materials, labor, subcontractors) — it tells you whether your pricing covers job-level expenses. Net profit margin subtracts all expenses including overhead, taxes, insurance, and administrative costs — it tells you whether your entire business model is profitable. You can have a healthy gross margin but a poor net margin if your overhead expenses are too high.

How do profitability ratios help with pricing decisions?

Profitability ratios give you data to replace guesswork in pricing. If your gross profit margin on a service is below 40%, you are likely undercharging. Comparing margins across service types reveals which offerings deserve premium pricing and which should be phased out. Tracking these ratios over time also shows whether price increases are sticking or whether rising costs are eroding your margins.

Can I calculate profitability ratios from my invoices alone?

Your invoices provide a strong starting point — they contain revenue data, service categories, and often labor hours. To calculate all four ratios, you also need expense records separated into direct costs (job-specific) and overhead (general business costs). Invoicing tools like Pronto Invoice that link invoices to expenses and categorize by service type make this process significantly easier.

There is always something more to read

What Does Invoice Date Mean? A Complete Guide to Invoice Dates and Payment Terms

What does invoice date mean? Learn how the invoice date differs from due date and service date, plus how proper dating accelerates your payments.

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.

How to Write a Painting Invoice That Gets You Paid Fast

Learn how to write a painting invoice that gets paid fast. Covers square footage billing, paint vs labor costs, and prep work itemization.