Sample Chart of Accounts for Small Business: Free Template + Setup Guide

Free sample chart of accounts for small business with industry templates and QuickBooks/Xero setup guide.

You finished a job, sent an invoice, got paid — but when tax season arrives, you cannot figure out where that money went. Your accountant asks for income by category, and you stare at a spreadsheet that makes no sense. This chaos stems from one missing foundation: a sample chart of accounts for small business that actually fits how you work.

A chart of accounts is not just an accounting formality. It is the organizational backbone that turns financial confusion into clarity. Whether you are an HVAC technician tracking equipment purchases, a freelance designer categorizing software subscriptions, or a plumbing contractor managing vehicle expenses, the right chart of accounts template makes every financial decision easier.

This guide provides a ready-to-use sample chart of accounts for small business owners, industry-specific customizations for contractors and freelancers, and step-by-step setup instructions for QuickBooks and Xero. By the end, you will have small business accounting categories tailored to your operations that take minutes to implement.

Table of Contents

- What Is a Chart of Accounts?

- The Five Small Business Accounting Categories

- Sample Chart of Accounts Template for Small Business

- Industry-Specific Chart of Accounts Customizations

- How to Set Up Your QuickBooks Chart of Accounts

- Xero Chart of Accounts Setup Guide

- Common Chart of Accounts Mistakes to Avoid

- Connecting Your Invoicing to Your Chart of Accounts

- Frequently Asked Questions

- Next Steps

What Is a Chart of Accounts?

A chart of accounts is a complete list of every financial account your business uses to record transactions. Think of it as a filing system for money — every dollar that enters or leaves your business gets categorized into a specific account.

When a customer pays an invoice, that payment goes into an income account. When you buy tools, that expense goes into an equipment account. When you take out a loan, that liability goes into a loans payable account.

Without this structure, your financial records become a jumbled mess of transactions with no context. With a properly organized chart of accounts, you can answer critical questions instantly:

- How much did I spend on vehicle expenses this quarter?

- What percentage of my income comes from service calls versus installations?

- Are my material costs increasing year over year?

- Which revenue streams generate the highest profit margins?

Small businesses typically need 30 to 60 accounts in their chart of accounts. Too few, and you lack the detail needed for informed decisions. Too many, and you waste time on transactions that could be grouped together. A service business with no inventory might start with 25 accounts, while a contractor managing subcontractors and materials may need closer to 60.

Why a Chart of Accounts Matters for Tax Preparation

A well-structured chart of accounts directly maps to the line items on your tax return. When your small business accounting categories align with IRS Schedule C categories — advertising, insurance, office expenses, vehicle expenses — your accountant spends less time reclassifying transactions and you pay less in preparation fees. This alignment also helps you identify tax deductions you might otherwise miss, like the difference between repairs (fully deductible) and improvements (depreciated over time).

The Five Small Business Accounting Categories

Every chart of accounts uses the same five core categories. Understanding these small business accounting categories helps you customize your accounts correctly and maintain clean service business bookkeeping.

1. Assets (1000-1999)

What your business owns. This includes:

- Current Assets: Cash, accounts receivable, inventory — items you can convert to cash within a year

- Fixed Assets: Equipment, vehicles, property — long-term items used in operations

2. Liabilities (2000-2999)

What your business owes. This includes:

- Current Liabilities: Credit card balances, accounts payable, short-term loans due within a year

- Long-Term Liabilities: Equipment loans, mortgages, obligations beyond one year

3. Equity (3000-3999)

Your ownership stake in the business. This includes:

- Owner’s capital contributions

- Retained earnings from previous years

- Owner’s draws or distributions

4. Revenue/Income (4000-4999)

Money your business earns. This includes:

- Service income

- Product sales

- Other income sources like interest or rental income

5. Expenses (5000-6999)

Money your business spends to operate. This includes:

- Cost of goods sold (materials, subcontractors)

- Operating expenses (rent, insurance, software)

- Payroll costs (wages, taxes, benefits)

Understanding how these categories connect is essential. Your assets minus liabilities equals equity — this is the fundamental accounting equation. Revenue increases equity, while expenses decrease it. When every transaction posts to the correct account, your statement of accounts and financial reports stay accurate automatically.

Sample Chart of Accounts Template for Small Business

Here is a complete sample chart of accounts for small business that works for most service-based companies. This chart of accounts template uses standard numbering you can adjust based on your accounting software preferences.

Assets (1000-1999)

| Account # | Account Name | Type |

|---|---|---|

| 1000 | Business Checking | Bank |

| 1010 | Business Savings | Bank |

| 1100 | Accounts Receivable | Current Asset |

| 1200 | Inventory | Current Asset |

| 1300 | Prepaid Expenses | Current Asset |

| 1400 | Security Deposits | Current Asset |

| 1500 | Vehicles | Fixed Asset |

| 1510 | Accumulated Depreciation - Vehicles | Fixed Asset |

| 1600 | Equipment | Fixed Asset |

| 1610 | Accumulated Depreciation - Equipment | Fixed Asset |

| 1700 | Tools | Fixed Asset |

Liabilities (2000-2999)

| Account # | Account Name | Type |

|---|---|---|

| 2000 | Accounts Payable | Current Liability |

| 2100 | Credit Card Payable | Current Liability |

| 2200 | Sales Tax Payable | Current Liability |

| 2300 | Payroll Liabilities | Current Liability |

| 2400 | Short-Term Loans | Current Liability |

| 2500 | Vehicle Loans | Long-Term Liability |

| 2600 | Equipment Loans | Long-Term Liability |

Equity (3000-3999)

| Account # | Account Name | Type |

|---|---|---|

| 3000 | Owner’s Capital | Equity |

| 3100 | Owner’s Draw | Equity |

| 3200 | Retained Earnings | Equity |

Revenue (4000-4999)

| Account # | Account Name | Type |

|---|---|---|

| 4000 | Service Revenue | Income |

| 4100 | Product Sales | Income |

| 4200 | Labor Income | Income |

| 4300 | Parts/Materials Markup | Income |

| 4400 | Service Agreements | Income |

| 4900 | Other Income | Income |

Expenses (5000-6999)

| Account # | Account Name | Type |

|---|---|---|

| 5000 | Cost of Goods Sold | COGS |

| 5100 | Materials & Supplies | COGS |

| 5200 | Subcontractor Costs | COGS |

| 6000 | Advertising & Marketing | Expense |

| 6050 | Bank Fees | Expense |

| 6100 | Insurance | Expense |

| 6150 | Interest Expense | Expense |

| 6200 | Licenses & Permits | Expense |

| 6250 | Office Supplies | Expense |

| 6300 | Professional Fees (Accounting/Legal) | Expense |

| 6350 | Rent | Expense |

| 6400 | Repairs & Maintenance | Expense |

| 6450 | Software & Subscriptions | Expense |

| 6500 | Telephone & Internet | Expense |

| 6550 | Travel & Meals | Expense |

| 6600 | Utilities | Expense |

| 6650 | Vehicle Expenses | Expense |

| 6700 | Wages & Salaries | Expense |

| 6750 | Payroll Taxes | Expense |

| 6800 | Continuing Education & Training | Expense |

Numbering tip: Leave gaps between account numbers so you can add new accounts later without reorganizing. For example, jumping from 6050 to 6100 leaves room for future accounts like 6060 or 6075.

Industry-Specific Chart of Accounts Customizations

The chart of accounts template above works as a starting point, but your industry requires specific modifications for accurate service business bookkeeping. Below are customizations for the most common small business types.

HVAC Contractors

HVAC businesses need to track multiple revenue streams and specialized materials. Add these accounts to your sample chart of accounts for small business. For more on structuring your HVAC invoices, see our complete guide.

Additional revenue accounts:

- 4010 - Installation Revenue

- 4020 - Repair Revenue

- 4030 - Maintenance Agreement Revenue

- 4040 - Emergency Service Revenue

Additional expense accounts:

- 5110 - Refrigerant Costs

- 5120 - HVAC Parts

- 5130 - Ductwork Materials

- 6410 - EPA Certification & Training

Plumbers

Plumbing contractors benefit from separating residential and commercial revenue to identify their most profitable segments. These additions complement your plumbing invoice best practices.

Additional revenue accounts:

- 4010 - Residential Service Calls

- 4020 - Commercial Contracts

- 4030 - New Construction

- 4040 - Drain Cleaning

Additional expense accounts:

- 5110 - Pipe & Fittings

- 5120 - Fixtures

- 5130 - Specialty Tools

- 6210 - Plumbing Licenses

Electricians

Electrical contractors should track license-specific expenses and separate project types for profitability analysis. Review our electrical contractor invoice guide for matching invoice line items to these accounts.

Additional revenue accounts:

- 4010 - Residential Electrical

- 4020 - Commercial Electrical

- 4030 - Panel Upgrades

- 4040 - Generator Installation

Additional expense accounts:

- 5110 - Electrical Supplies

- 5120 - Wiring Materials

- 5130 - Panels & Breakers

- 6210 - Electrical Licenses

Freelancers and Consultants

Freelancers and consultants should simplify the template by removing inventory-related accounts and adding income categories that match how they bill clients. For billing guidance, see our guides on consulting invoices and freelance invoicing.

Additional accounts:

- 4010 - Consulting Fees

- 4020 - Project Revenue

- 4030 - Retainer Income

- 6460 - Coworking Space

- 6470 - Professional Development

- 6480 - Portfolio & Website Hosting

How to Set Up Your QuickBooks Chart of Accounts

Setting up your QuickBooks chart of accounts takes about 20 minutes. QuickBooks Online provides default accounts, but customizing them to match this sample chart of accounts for small business ensures accurate reporting from day one.

Step 1: Access Chart of Accounts Navigate to Settings (gear icon) and select Chart of Accounts.

Step 2: Review Default Accounts QuickBooks creates default small business accounting categories automatically. Delete or rename accounts that do not apply to your business. Keep the system-generated accounts like Uncategorized Income and Uncategorized Expense — QuickBooks uses these as catch-all accounts.

Step 3: Add Custom Accounts Click “New” to add accounts from your template. For each account:

- Select the account type (Asset, Liability, etc.)

- Choose the detail type (e.g., Checking for bank accounts)

- Enter the account name

- Optionally add an account number (enable this in Settings, then Advanced, then Chart of Accounts)

Step 4: Enable Account Numbers To enable account numbers: Settings, then Advanced, then Chart of Accounts, then Enable account numbers. This matches the numbering system in the chart of accounts template above.

Step 5: Organize Sub-Accounts For complex categories, create sub-accounts. Example: Vehicle Expenses as the parent account with Gas, Repairs, and Insurance as sub-accounts.

Pro Tip: Import your chart of accounts from a CSV file to save time. QuickBooks accepts imports under Settings, then Import Data, then Chart of Accounts. Format your CSV with columns for Account Type, Detail Type, Name, and Number.

Xero Chart of Accounts Setup Guide

Xero provides a solid default chart of accounts that requires minimal customization for most small businesses.

Step 1: Access Chart of Accounts Navigate to Accounting, then Chart of Accounts.

Step 2: Review and Customize Xero organizes accounts differently than the QuickBooks chart of accounts. Review each section and archive accounts you do not need rather than deleting them. Archiving preserves historical data while keeping your active list clean.

Step 3: Add Custom Accounts Click “Add Account” and fill in:

- Account code (number)

- Account name

- Account type

- Tax rate (if applicable)

Step 4: Enable Tracking Categories Xero tracking categories let you analyze income and expenses by project, location, or job type without creating separate accounts. This keeps your chart of accounts template clean while providing detailed reports — especially valuable for service businesses running multiple jobs simultaneously.

Step 5: Lock Accounts Once set up, lock accounts you should not modify to prevent accidental changes during day-to-day bookkeeping.

Common Chart of Accounts Mistakes to Avoid

Even a well-designed sample chart of accounts for small business fails when these errors creep in. Here are the most common mistakes and how to prevent them.

1. Creating Too Many Accounts

A 200-account chart makes categorization confusing and slows down daily bookkeeping. Aim for 30 to 60 accounts maximum. If you need more detail, use sub-accounts or tracking categories instead of top-level accounts.

2. Inconsistent Naming Conventions

“Vehicle Expenses,” “Auto Costs,” and “Car Expenses” describing the same thing creates confusion and splits your data across multiple accounts. Establish naming conventions and stick to them. Pick one format — either “Category - Subcategory” or simple descriptive names — and apply it everywhere.

3. Mixing Personal and Business Expenses

Never run personal expenses through business accounts. This complicates taxes, threatens liability protection for LLCs and corporations, and makes your financial reports unreliable. If you are setting up a new business, establish separate accounts from the start.

4. Ignoring Tax Category Alignment

Your accountant and tax preparer expect certain accounts. When your expense categories align with IRS Schedule C line items, tax preparation goes faster and costs less. Deviating too far from standards creates extra work and increases the risk of missing deductions.

5. Not Matching Invoice Line Items to Revenue Accounts

Your invoices should use line items that map directly to your revenue accounts. If your chart has “Installation Revenue” and “Repair Revenue” as separate accounts, your invoices need matching categories. Invoicing software that syncs with QuickBooks or Xero should maintain these category mappings automatically. When your invoice line items align with your chart of accounts, your income reports generate accurately without manual adjustment. Learn more about structuring invoices for proper categorization in our guide on getting customers to pay faster.

Connecting Your Invoicing to Your Chart of Accounts

The power of a well-designed chart of accounts multiplies when your invoicing data flows into it automatically. Here is what that connection should look like in practice:

Invoice Line Items to Revenue Accounts When you create an invoice for an HVAC installation, that line item should automatically categorize as Installation Revenue (4010) in your accounting software. This eliminates manual reclassification at month end.

Payment Tracking to Accounts Receivable Outstanding invoices should update Accounts Receivable (1100) automatically. When payment arrives, the amount moves to your checking account (1000) while reducing receivables. Your statement of accounts stays current without manual updates.

Expense Categories to Expense Accounts Materials purchased for a job should flow into Materials & Supplies (5100) without manual entry.

How Transaction Flow Works in Practice

Here is a real-world example. You complete a plumbing repair and send a $450 invoice:

- Invoice created: Revenue account 4010 (Residential Service Calls) records $450, Accounts Receivable (1100) increases by $450

- Customer pays: Accounts Receivable decreases by $450, Business Checking (1000) increases by $450

- You purchased $80 in parts: Materials & Supplies (5100) increases by $80, Business Checking decreases by $80

When every transaction flows through the correct accounts, your profit and loss statement, balance sheet, and cash flow reports generate accurately with zero manual work.

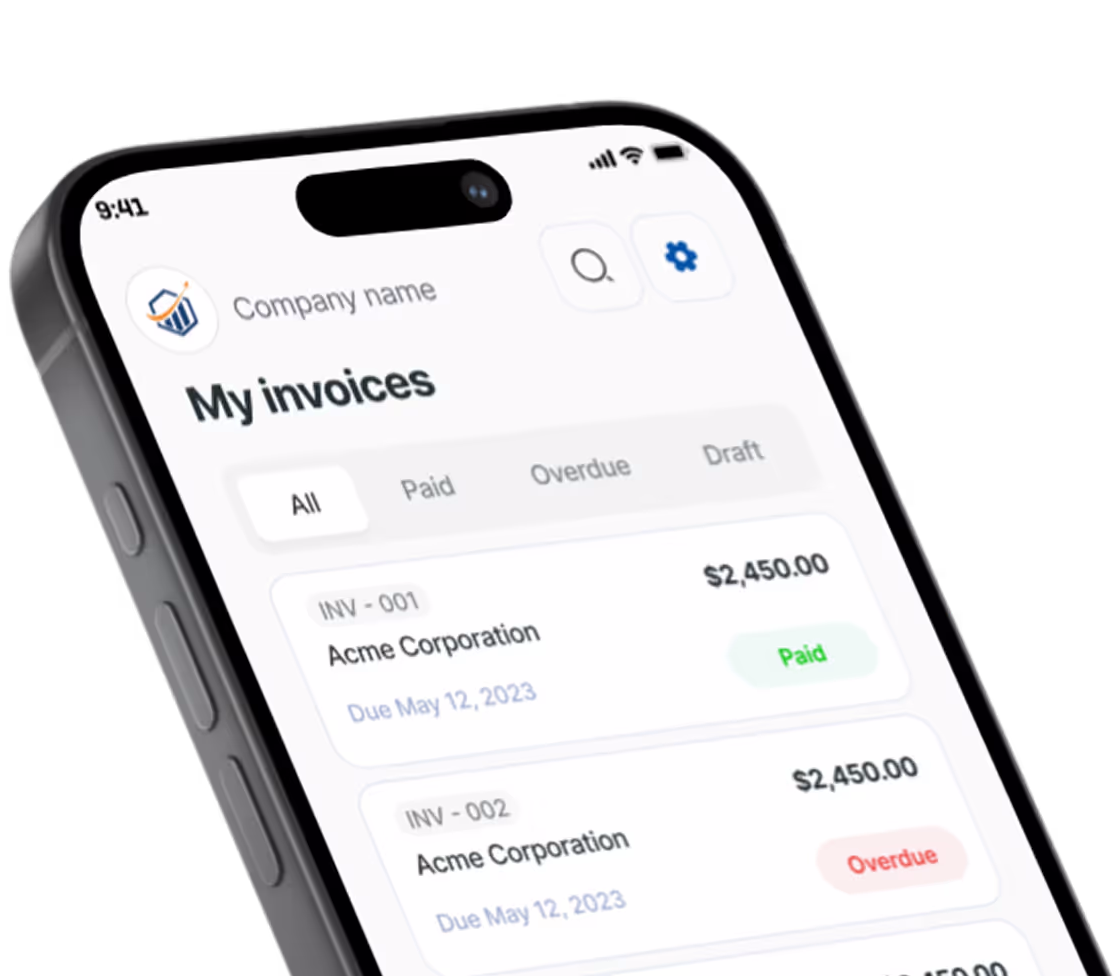

Modern invoicing tools like Pronto Invoice maintain this connection through accounting software integrations. When you set up income categories that match your chart of accounts, every invoice syncs correctly. The result: accurate financial reports without hours of manual categorization.

For field service professionals creating invoices on job sites, this integration matters even more. You need invoice data captured accurately in the moment — not reconstructed later from memory or handwritten notes.

Frequently Asked Questions

How many accounts should a small business chart of accounts have?

Most small businesses need 30 to 60 accounts. Too few accounts and you lack the detail needed for financial decisions. Too many and you waste time categorizing transactions that could be grouped together. Service businesses with simple operations can start with as few as 25 accounts, while businesses with inventory, multiple revenue streams, or subcontractors may need closer to 60.

What are the five main categories in a chart of accounts?

The five main small business accounting categories are Assets (what your business owns), Liabilities (what your business owes), Equity (your ownership stake), Revenue/Income (money earned), and Expenses (money spent to operate). These categories use a standard numbering system: Assets 1000-1999, Liabilities 2000-2999, Equity 3000-3999, Revenue 4000-4999, and Expenses 5000-6999.

Can I import a chart of accounts template into QuickBooks?

Yes. QuickBooks Online accepts chart of accounts imports from CSV files. Navigate to Settings, then Import Data, then Chart of Accounts. Prepare your CSV with columns for Account Type, Detail Type, Name, and optionally Account Number. QuickBooks Desktop also supports imports through the File menu under Utilities.

How often should I review my chart of accounts?

Review your chart of accounts at least once per year, ideally at the start of a new fiscal year. If your business is growing quickly or you have added new services, review quarterly. Make changes only at the end of an accounting period to avoid corrupting records. Never change accounts mid-month during active bookkeeping.

Should my invoice categories match my chart of accounts?

Yes. Your invoice line items should map directly to your revenue accounts. For example, if your chart of accounts has separate accounts for Installation Revenue and Repair Revenue, your invoices need matching line item categories. This alignment ensures accurate income reports without manual reclassification. Invoicing software like Pronto Invoice that integrates with QuickBooks or Xero maintains these mappings automatically.

Do I need a CPA to set up my chart of accounts?

You do not need a CPA, but consulting one is recommended — especially for your first setup. A CPA familiar with your industry can suggest accounts that align with tax reporting requirements, which simplifies year-end preparation. However, the sample chart of accounts for small business templates in this guide are sufficient for most service businesses to start with and can be refined with a CPA later.

Next Steps

You now have everything needed to set up a professional chart of accounts for your small business. Here is your action plan:

- Copy the template that matches your industry from the examples above

- Customize account names to reflect your specific services and expenses

- Set up accounts in your QuickBooks chart of accounts, Xero, or other accounting software

- Configure your invoicing to use line items matching your revenue accounts

- Review quarterly to ensure transactions are categorized correctly and accounts still reflect your operations

A properly structured sample chart of accounts for small business transforms your finances from a source of stress into a decision-making tool. You will know exactly where money comes from, where it goes, and how to improve profitability.

If you are just starting your business, this chart of accounts setup is one piece of a larger puzzle. Check out our complete guide on 10 Steps to Start a Small Business for the full roadmap. For more on managing your business finances, explore our guides on invoice payment terms and business overhead expenses.

There is always something more to read

Invoice Number Best Practices: The Complete Guide for Small Businesses

Master invoice number best practices with our guide to 4 numbering systems. Stay audit-ready and avoid costly mistakes.

How to Format an Invoice Properly: The Complete Checklist for 2025

Learn how to format an invoice properly with our checklist. Get professional format tips, layout best practices, and avoid delays.

How to Write a Receipt of Payment: Step-by-Step Guide (2025)

Learn how to write a receipt of payment in 7 steps. Includes free templates, required elements, and examples for contractors.