Statement of Accounts for Small Business: Complete Guide with Templates

Learn how to create and send a statement of accounts. Includes free templates, aging report tips, and best practices.

You just finished reviewing your outstanding invoices and noticed something frustrating: a longtime client has three unpaid invoices spanning the last 90 days. Do you send three separate payment reminders? Call them about each one? Or is there a better way to handle this without coming across as aggressive or disorganized?

This is exactly where a statement of accounts for small business operations becomes your most valuable tool. For business owners juggling multiple clients with ongoing work, understanding how to use statements effectively can transform your collections process—and protect the relationships you have worked hard to build.

Small businesses in the US collectively hold $825 billion in unpaid invoices—equal to 5% of the nation’s GDP. A well-crafted statement of accounts helps you recover your share faster while maintaining professionalism.

This guide breaks down everything you need to know about creating and sending statements of accounts for small business clients, including when to use them, how to structure them, and account statement templates you can start using today.

What Is a Statement of Accounts?

A statement of accounts is a financial document that summarizes all transactions between your business and a specific client over a defined period. Unlike an invoice, which requests payment for a single transaction or project, a statement provides a comprehensive view of the entire account relationship.

Think of it this way:

- Invoice: A bill for one specific job or delivery

- Statement of accounts: A summary showing all invoices, payments received, credits applied, and the current balance owed

A typical statement of accounts for small business use includes:

- Client name and account information

- Statement period (e.g., January 1-31, 2025)

- List of all invoices issued during the period

- Payments received and applied

- Any credits or adjustments

- Running balance and total amount due

- Aging breakdown (current, 30 days, 60 days, 90+ days)

For small businesses with repeat clients—whether you are an HVAC contractor with service agreements or a freelance designer on monthly retainer—statements provide clarity that individual invoices simply cannot. Businesses that issue regular statements of accounts experience up to a 35% reduction in payment disputes compared to those relying solely on individual invoices.

Customer Statement vs Invoice: Understanding the Key Differences

Understanding when to use each document prevents confusion and keeps your accounts receivable organized. The distinction between a customer statement vs invoice is fundamental to professional billing practices.

| Aspect | Invoice | Statement of Accounts |

|---|---|---|

| Purpose | Request payment for specific work | Summarize account activity and balance |

| Frequency | Per job, project, or delivery | Monthly or periodic |

| Content | Single transaction details | Multiple transactions over time |

| Timing | Immediately after work completion | End of billing cycle or on request |

| Legal status | Payment demand with obligation | Account summary (informational) |

| Accounting treatment | Creates accounts receivable | No new accounting entry |

Use an invoice when:

- You complete a one-time project

- A client pays per job with no ongoing relationship

- You need an immediate payment request

Use a statement of accounts when:

- You have multiple outstanding invoices with one client

- You work with clients on ongoing terms (net 30, net 60)

- You want to provide a monthly account summary

- A client requests a consolidated view of their account

- You need to address overdue balances diplomatically

Monthly Statement Best Practices: When to Send a Statement of Accounts

Timing matters. Send statements too frequently and you seem desperate; too infrequently and clients lose track of what they owe. Following monthly statement best practices ensures maximum effectiveness. Here are the most effective scenarios for sending statements.

Monthly Account Summaries (Standard Practice)

For clients with ongoing work or payment terms, send a statement at the end of each month. This is the industry standard for small business accounting. A monthly statement serves as both a courtesy recap and a gentle reminder of outstanding balances.

Best for: Contractors with service agreements, consultants on retainer, suppliers with regular orders

Before Payment Terms Expire

If a client has multiple invoices approaching their due dates, a consolidated statement helps them plan payment. Send it 5-7 days before the earliest due date.

When Invoices Become Overdue

A statement is often more effective than multiple individual reminder emails. It shows professionalism and gives the client a complete picture without the awkwardness of repeated “just checking in” messages.

According to a 2021 survey, 25% of small business owners report not getting paid until 20-30 days after the payment due date. Regular statements help close this gap.

Upon Client Request

Some clients—especially those with their own accounting departments—prefer statements over individual invoices for their records. Accommodate this preference to make doing business with you easier.

At Quarter or Year End

Many businesses reconcile accounts quarterly or annually. Proactively sending a statement during these periods positions you as organized and helps ensure your invoices are included in their payment runs.

How to Create an Effective Account Statement Template

A well-structured account statement template makes it easy for clients to understand exactly what they owe and why. Include these essential elements:

Header Information

- Your business name, address, and contact details

- Client name and billing address

- Statement date and period covered

- Account number or customer ID (if applicable)

Account Overview Section

Display prominently at the top:

- Opening balance (carried from previous period)

- Total new charges this period

- Total payments received this period

- Credits or adjustments applied

- Current balance due (highlighted)

Transaction Details

List each transaction chronologically with:

- Date of transaction

- Reference number (invoice or payment ID)

- Description of charge or payment

- Amount charged or paid

- Running balance after each entry

Aging Report Summary

Break down the outstanding balance by age:

- Current (not yet due)

- 1-30 days past due

- 31-60 days past due

- 61-90 days past due

- Over 90 days past due

Payment Information

- Accepted payment methods

- Payment instructions or link

- Due date for payment

- Remittance address (if applicable)

Modern invoicing software can generate these statements automatically from your invoice history, pulling together all the data without manual compilation. This eliminates errors and saves hours of administrative work—time better spent on billable activities.

Statement of Accounts Email Templates

How you present the statement matters as much as the statement itself. Here are templates for different situations.

Template 1: Monthly Statement (No Overdue Balance)

Subject: Your [Month] Account Statement – [Your Business Name]

Hi [Client Name],

Please find attached your account statement for [Month Year].

This statement summarizes all invoices and payments during this period. Your current balance is [Amount].

If you have any questions about your account, please let me know. Thank you for your continued business.

Best regards, [Your Name] [Your Business Name] [Phone Number]

Template 2: Statement with Overdue Balance

Subject: Account Statement – Balance Due [Amount]

Hi [Client Name],

Attached is your current account statement showing all activity through [Date].

I noticed there are some invoices past their due dates, with a total overdue balance of [Amount]. I have included a complete breakdown in the attached statement.

If there is anything preventing payment or if you would like to discuss a payment arrangement, please let me know. I am happy to work with you to resolve this.

Thank you, [Your Name] [Your Business Name] [Phone Number]

Template 3: Statement with Significantly Overdue Balance (60+ Days)

Subject: Important: Account Statement Requires Attention

Hi [Client Name],

I am reaching out regarding your account, which shows a balance of [Amount] with invoices dating back to [Oldest Invoice Date].

I have attached a detailed statement for your review. Understanding that circumstances can change, I would appreciate the opportunity to discuss the account and find a resolution that works for both of us.

Please contact me at your earliest convenience so we can address this together.

Regards, [Your Name] [Your Business Name] [Phone Number]

Understanding Aging Reports for Small Business

An aging report—often included within or alongside your statement—categorizes outstanding balances by how long they have been unpaid. This is essential for managing cash flow and prioritizing collection efforts.

Why Aging Reports Matter for Small Business Owners

- Cash flow visibility: See at a glance how much money is tied up in receivables

- Risk identification: Spot clients trending toward non-payment early. When standard follow-ups fail, learn how to handle late paying clients

- Collection prioritization: Focus efforts where they will have the most impact

- Financial planning: Make informed decisions about expenses and growth

- Credit policy refinement: Adjust terms based on payment patterns

Roughly one in three small businesses (30%) report that outstanding invoices create cash flow problems that jeopardize their ability to remain in business.

Reading Your Aging Report

A typical aging report groups balances into buckets:

| Aging Bucket | What It Means | Action Required |

|---|---|---|

| Current | Not yet due | None—invoice is on schedule |

| 1-30 days | Recently past due | Send friendly reminder |

| 31-60 days | Moderately overdue | Send statement, make phone call |

| 61-90 days | Significantly overdue | Escalate communication, consider payment plan |

| 90+ days | Seriously delinquent | Final notice, consider collections |

The Critical 90-Day Threshold

The longer an invoice remains unpaid, the less likely you are to collect it. A 2022 analysis of 250,000 invoices found that an invoice remaining unpaid after 90 days had only an 18% chance of being collected—making early intervention through regular statements critical for small business cash flow.

Aging Report Best Practices

Leading companies run aging reports weekly or even daily, rather than waiting for monthly financial close. This regular oversight helps catch payment issues before they become serious problems.

Best Practices for Sending Statements Without Damaging Relationships

Requesting payment can feel uncomfortable, especially with clients you value. These practices help you get paid while maintaining positive relationships.

Be Consistent with Monthly Statements

Send statements on a predictable schedule. When clients know to expect a monthly statement, it feels like standard business practice rather than pressure.

Stay Professional, Not Personal

Frame overdue balances as account matters, not personal failings. “Your account shows a balance” is better than “You have not paid.”

Make Payment Easy

Include payment links, accepted methods, and clear instructions on every statement. Reduce friction wherever possible.

Offer Solutions Before Ultimatums

If a client is struggling, suggest payment plans before threatening consequences. You often recover more by being flexible than by being rigid.

Consider Early Payment Incentives

Offering a small discount (such as 2% for payment within 10 days) can accelerate collections while maintaining goodwill.

Document Everything

Keep records of all statements sent and communications made. This protects you legally and provides context for future interactions.

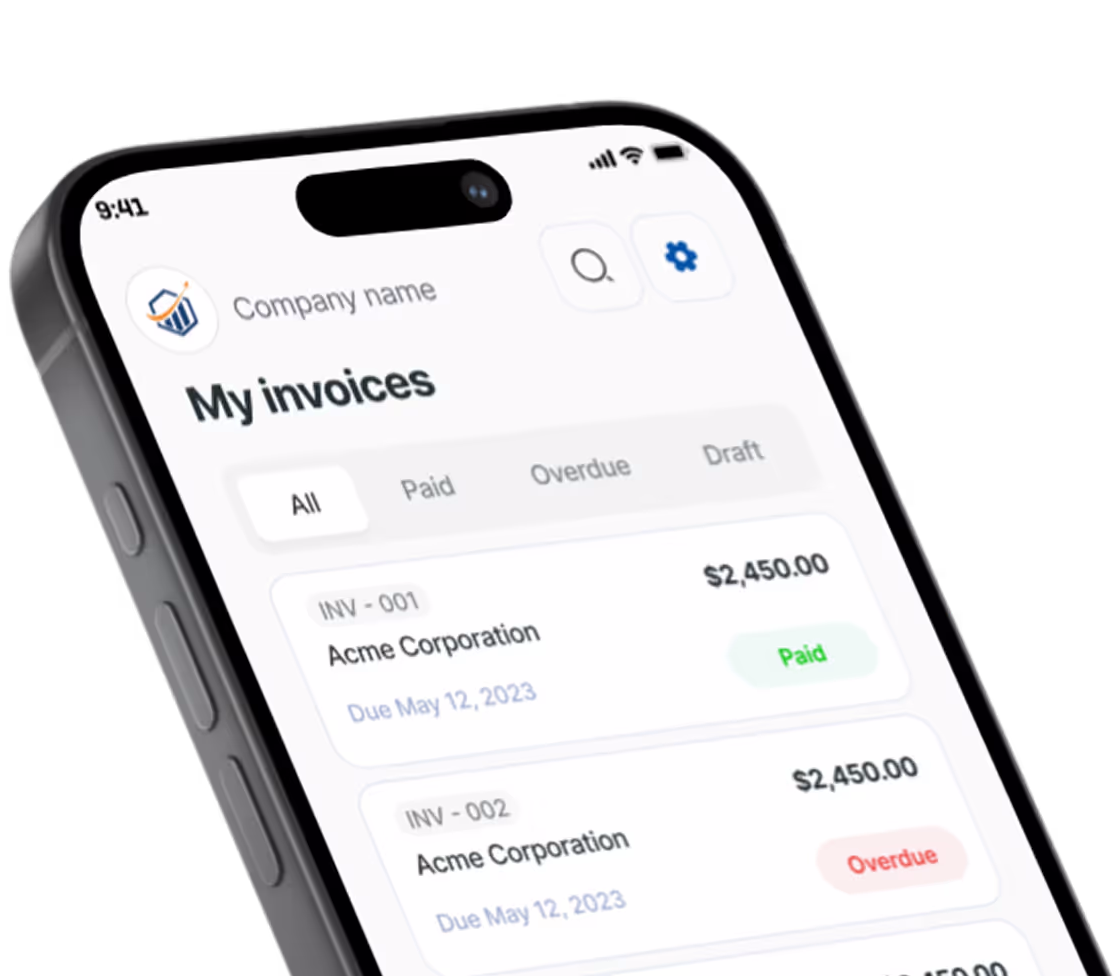

Automate Where Possible

Manual statement creation is time-consuming and error-prone. Invoicing tools like Pronto Invoice can automatically generate statements from your invoice history, apply payments, calculate aging, and even send them on schedule. This consistency ensures no client slips through the cracks while freeing you to focus on your actual work.

Turning Statements into a Cash Flow Tool

When used strategically, statements of accounts for small business operations become more than summaries—they become active tools for improving cash flow.

Set expectations early. Mention in your client onboarding that you send monthly statements. This normalizes the practice.

Use statements to forecast. Your aging report tells you what cash should arrive when, helping you plan expenses and growth.

Track payment patterns. Clients who consistently pay late may need different terms—or may not be worth retaining.

Celebrate prompt payers. A statement showing a zero balance is an opportunity to thank clients for their reliability. Note: Customers with a zero balance do not need to be sent a statement unless they specifically request one.

Link AR data to weekly cash flow reviews. Segment customers by risk and set collection strategies accordingly.

Take Control of Your Accounts Receivable

A statement of accounts for small business operations is not just a document—it is a communication tool that brings clarity to complex client relationships. Whether you are managing a handful of regular clients or dozens of ongoing accounts, mastering the statement process directly impacts your cash flow and client relationships.

Start by reviewing your current outstanding invoices. Identify clients with multiple unpaid invoices or overdue balances. Create or generate a statement for each, and send it with one of the email templates above.

If compiling statements manually feels overwhelming, consider invoicing software that automates the process. With Pronto Invoice, statements are generated automatically from your invoice history—complete with aging breakdowns and payment tracking—so you always have an accurate, professional summary ready to send.

The goal is simple: make it easy for clients to understand what they owe and easy for them to pay. A well-crafted statement achieves both while positioning your business as organized, professional, and worth doing business with.

Frequently Asked Questions

What is the difference between a statement of accounts and an invoice?

An invoice is a request for payment for a specific transaction, typically issued immediately after goods or services are delivered. A statement of accounts summarizes all transactions—invoices, payments, and credits—over a period of time, usually monthly. While an invoice creates an accounts receivable entry, a statement is informational and does not affect your accounting records.

How often should I send a statement of accounts to clients?

Monthly is the standard practice for small businesses. Sending statements at the end of each month helps clients track their account balance, catches billing errors early, and serves as a professional reminder for outstanding payments. Some businesses send statements quarterly, but monthly frequency typically results in better payment outcomes.

Do I need to send a statement if the client has a zero balance?

No. Customers with a zero balance on their account do not need to receive a statement unless they specifically request one for their records. Focus your statement efforts on clients with outstanding balances.

What should I include in an aging report?

An aging report should categorize outstanding balances by how long they have been past due: Current (not yet due), 1-30 days, 31-60 days, 61-90 days, and 90+ days. Include the customer name, invoice numbers, amounts owed in each category, and total balance due. This helps prioritize collection efforts.

Can a statement of accounts serve as a payment reminder?

Yes. While a statement is technically informational rather than a payment demand, it effectively reminds clients of outstanding balances without the direct pressure of a collection notice. Many small businesses use monthly statements as their primary tool for gentle payment reminders.

What happens if an invoice goes unpaid for more than 90 days?

Research shows invoices unpaid after 90 days have only an 18% chance of being collected. At this stage, consider escalating to direct phone calls, offering a payment plan, or engaging a collection agency. The key is addressing overdue invoices well before they reach this critical threshold.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.