What Does Invoice Date Mean? A Complete Guide to Invoice Dates and Payment Terms

What does invoice date mean? Learn how the invoice date differs from due date and service date, plus how proper dating accelerates your payments.

You just finished a three-hour HVAC repair. The homeowner is happy, the system is running, and you need to get paid. But when you sit down to create the invoice, you pause: what does invoice date mean, and which date should you put on it?

The answer matters more than most business owners realize. The invoice date affects when you legally expect payment, how you track revenue for taxes, and ultimately, how quickly cash lands in your bank account.

Let us break down exactly what invoice date means, how it differs from other dates on your invoices, and how to use dating strategically to improve your cash flow.

What Does Invoice Date Mean? Definition and Purpose

The invoice date is the date when an invoice is officially created and issued to the client. It serves as the starting point for payment terms and establishes when your business officially requests payment for goods or services.

Think of the invoice date as the timestamp that says, “Payment clock starts now.”

For example, if your invoice date is March 15 and your payment terms are Net 30, your client has until April 14 to pay without being considered late. Understanding what invoice date means is essential because this single date determines your entire payment timeline.

According to Invoice Ninja, the invoice date is crucial for tracking revenue, managing accounts receivable, and maintaining accurate financial records.

Invoice Date vs Due Date vs Service Date: Understanding the Difference

Most invoices contain three date-related elements. Understanding each one prevents confusion for both you and your clients.

+---------------------------------------------------------------------+

| INVOICE DATE TIMELINE |

+---------------------------------------------------------------------+

| |

| SERVICE DATE INVOICE DATE DUE DATE |

| | | | |

| March 10 March 15 April 14 |

| (Work performed) (Invoice created) (Payment expected) |

| | | | |

| +------ 5 days -------+------ 30 days -----+ |

| |

| The gap between service date and invoice date |

| is money sitting in your client's pocket, not yours. |

| |

+---------------------------------------------------------------------+Service Date (or Delivery Date)

The service date is when you actually performed the work or delivered the product. For a plumber, it is the day you fixed the pipe. For a photographer, it is the day you shot the wedding.

The service date matters for:

- Accurate record-keeping

- Warranty start dates

- Disputes about work completion

Invoice Date (or Issue Date)

The invoice date is when you create and send the invoice. In most cases, “invoice date” and “issue date” mean the same thing, though some businesses use “issue date” specifically for the moment the invoice is transmitted to the client.

According to SumUp, the delivery date must be indicated on the invoice if it differs from the issue date.

The invoice date matters for:

- Calculating payment due dates

- Tax reporting (especially for accrual accounting)

- Legal documentation if payment disputes arise

- Accounts receivable aging reports

Due Date

The due date is when payment is expected. This is calculated from the invoice date based on your payment terms.

| Payment Terms | Invoice Date | Due Date |

|---|---|---|

| Due on Receipt | March 15 | March 15 |

| Net 15 | March 15 | March 30 |

| Net 30 | March 15 | April 14 |

| Net 60 | March 15 | May 14 |

Why the Invoice Date Matters for Your Cash Flow

The Hidden Cost of Delayed Invoicing

Here is the uncomfortable math: If you wait five days after completing a job to send an invoice, and your client takes the full 30 days to pay, you are waiting 35 days for money you already earned.

Multiply that by every job, and you could have weeks of revenue sitting in limbo at any given time.

The fix is simple: Invoice immediately upon job completion. Same-day invoicing, ideally before you even leave the job site, can shave days or weeks off your payment timeline.

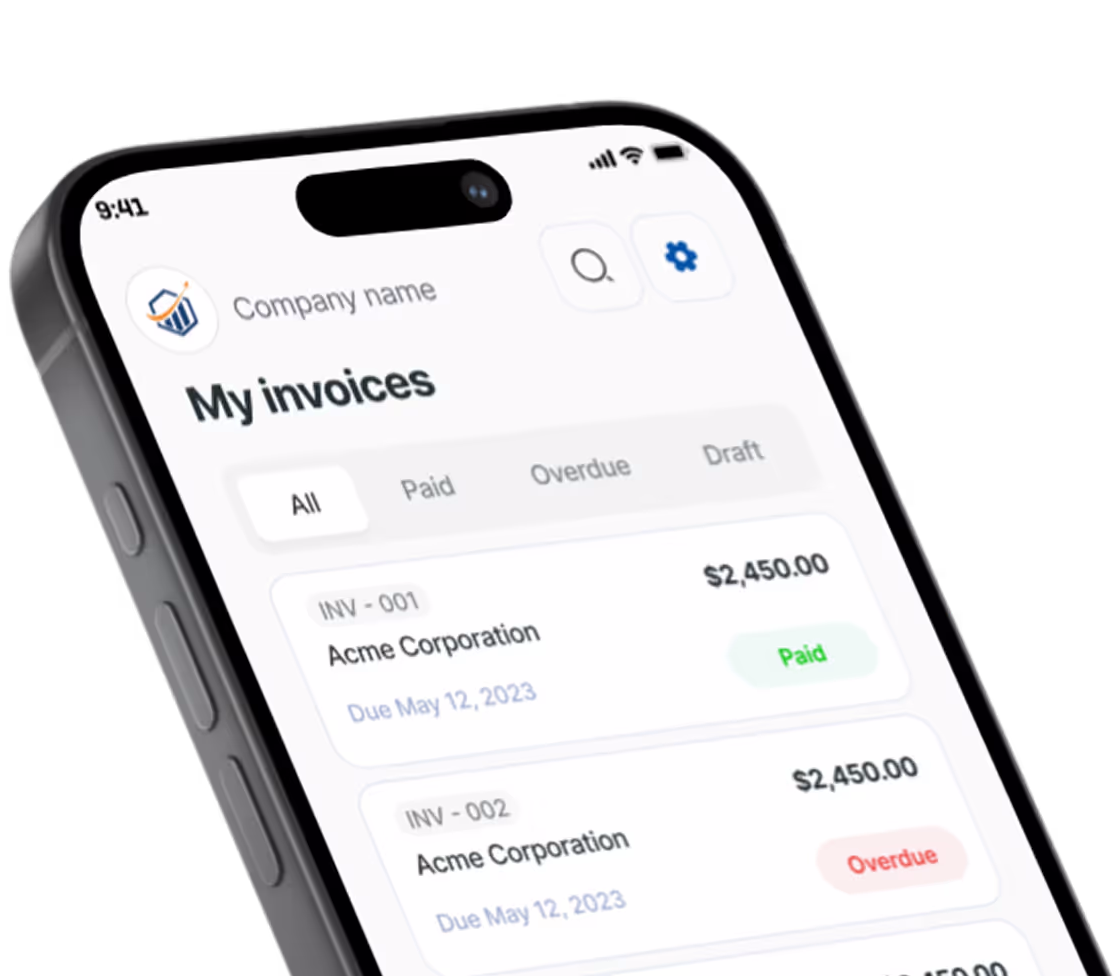

This is where mobile invoicing becomes critical. Instead of waiting until you get back to the office or find time at the end of the week, you can create and send professional invoices right from your phone. Tools like Pronto Invoice are built specifically for this scenario, letting field service professionals generate invoices in under 60 seconds while the job is still fresh in everyone’s mind.

Legal and Tax Implications of Invoice Dates

The invoice date often determines:

- When revenue is recognized for tax purposes (important for accrual-basis accounting)

- Statute of limitations for collecting unpaid invoices

- Evidence in disputes about when payment was requested

According to INV24, the invoice date helps determine the cut-off period for auditing and tax liability calculations.

If you ever need to pursue a late payment through collections or small claims court, the invoice date is a critical piece of documentation. Learn more about how to send someone to collections when standard collection methods fail.

Client Psychology and Payment Behavior

Clients mentally anchor to the invoice date. An invoice dated March 15 with Net 30 terms feels different than one dated March 1 with the same due date of April 14, even though the due date is identical.

Prompt invoicing signals professionalism and sets clear expectations from the start.

Can You Backdate an Invoice?

Technically, you control what date appears on your invoice. But should you backdate?

Legitimate reasons to adjust an invoice date:

- Correcting a clerical error (you meant to invoice on the 10th but accidentally dated it the 11th)

- Matching the service date when that is your established billing practice

Problematic backdating:

- Manipulating revenue recognition for tax purposes

- Misleading clients about when payment terms began

- Covering up delays in your invoicing process

The safest practice: Invoice promptly and date invoices accurately. If you consistently struggle to invoice on time, the solution is not backdating. It is fixing your invoicing process with tools designed for faster invoicing on the go.

Invoice Date Accounting Rules

For businesses using accrual accounting, the invoice date carries significant weight:

- Revenue recognition: You record income when the invoice is issued, not when payment is received. This distinction matters for your chart of accounts

- Period assignment: The invoice date determines which accounting period the transaction belongs to

- Accounts receivable aging: Aging reports calculate how long invoices have been outstanding based on the invoice date

For cash-basis accounting, the invoice date is less critical for tax purposes since you record income when payment is received. However, it still matters for tracking outstanding payments and managing cash flow.

Best Practices for Invoice Dating

1. Invoice Immediately After Job Completion

The single most effective change you can make. Do not wait until Friday to batch your invoices. Do not wait until you are “back at the office.” Invoice before you leave the job site.

For HVAC technicians, plumbers, and electrical contractors, this means creating invoices on your phone or tablet immediately after completing repairs.

2. Be Consistent with Your Dating Practice

Whether you date invoices on the service date or the day you create them, pick one approach and stick with it. Consistency makes your records easier to understand and defend during audits or disputes.

3. Make the Due Date Prominent

Some clients focus on the invoice date; others look only at the due date. Make both prominent and easy to find. Bold the due date or place it in a colored box on your invoice template.

4. Consider Shorter Payment Terms

If cash flow is tight, Net 15 or even Due on Receipt may serve you better than Net 30. Just communicate terms clearly upfront, ideally in your quotes and estimates before work begins.

5. Automate Date Calculations

Manual date math leads to errors. Modern invoicing software automatically calculates due dates based on your payment terms, eliminating the risk of typos or miscalculations.

Frequently Asked Questions About Invoice Dates

What is the difference between invoice date and issue date?

In most contexts, invoice date and issue date are used interchangeably. Both refer to the date when the invoice is created and sent to the client. Some accounting systems distinguish between the creation date (invoice date) and the date it was transmitted (issue date), but for most small businesses, they are the same.

Can I change an invoice date after sending it?

You can issue a corrected invoice with the accurate date, but you should not simply alter the original invoice. Issue a credit note for the original invoice and create a new invoice with the correct date. Always maintain a clear audit trail of any corrections.

What invoice date should I use for recurring services?

For recurring services like monthly retainers or subscriptions, use the date you generate and send the invoice each billing cycle. Most businesses invoice on the first of the month for that month’s services or on the last day for the previous month’s services.

Does the invoice date affect taxes?

Yes, particularly for businesses using accrual accounting. The invoice date determines when revenue is recognized for tax purposes. For cash-basis businesses, the payment date matters more for taxes, but the invoice date still affects when you report accounts receivable.

How long after service can I send an invoice?

There is no legal maximum, but best practice is to invoice immediately or within 24-48 hours of completing work. The longer you wait, the longer you wait to get paid, and the harder it becomes to collect if issues arise.

The Bottom Line: Date It Right, Get Paid Faster

Understanding what invoice date means is fundamental to running a healthy business. The invoice date is not just a formality. It is the starting gun for getting paid. Every day between completing work and sending an invoice is a day you are essentially giving your client an interest-free loan.

Key takeaways:

- The invoice date starts the payment term clock

- Invoice date and issue date typically mean the same thing

- Service date, invoice date, and due date serve different purposes

- Invoice immediately after job completion to accelerate payments

- Be consistent and accurate in your dating practices

- Use technology to invoice from anywhere, anytime

For field service professionals, contractors, and freelancers who work on the go, mobile-first invoicing tools like Pronto Invoice make same-day invoicing practical rather than aspirational. When you can create a professional invoice in under a minute from your phone, even without an internet connection, there is no reason to delay.

Your work is done. Your invoice should be too.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.