What Is a PO Number on an Invoice? A Complete Guide for Small Businesses

Learn what a PO number is, why corporate clients require them, and how to add them correctly to avoid payment delays.

You just landed your first contract with a corporate client or government agency. The job goes smoothly, you send your invoice, and then you get the dreaded email: “We cannot process this invoice without a valid PO number.”

If you have never encountered purchase orders before, this can feel like hitting an unexpected wall between you and your payment. But understanding what is a PO number on an invoice is simpler than it seems. Once you know how purchase order numbers work and how to handle them, they become a straightforward part of doing business with larger organizations.

This guide explains everything you need to know about PO numbers, from what they mean to how to include them on your invoices correctly.

What Is a PO Number? Definition and Meaning

A PO number (purchase order number) is a unique identifier assigned by a buyer to track a specific purchase. When a company issues a purchase order to you, that document includes a PO number that links the transaction to their internal accounting and approval systems.

Quick Definition: A PO number is a reference code that connects your invoice to a client’s pre-approved authorization to spend money. Without it, their accounts payable department cannot verify that someone in their organization actually approved the purchase.

Think of the purchase order number as the thread connecting your work to their payment system. It proves the purchase was authorized before money changes hands.

PO Number Format Examples

Purchase order numbers typically follow a structured format that may include:

- Sequential numbers: PO-0001, PO-0002, PO-0003

- Date-based: PO-2025-0142 (year + sequence)

- Department codes: IT-2025-0089, MKT-2025-0034

- Combined format: PO-2025-4567-HVAC (year + sequence + category)

The format varies by organization, but every PO number is unique within that company’s system.

How Purchase Orders Work: The Complete Process

Understanding the purchase order workflow helps you navigate corporate client relationships more effectively. Here is the typical flow when working with a client that uses purchase orders:

- You provide a quote or estimate for your products or services

- The client creates a purchase order with a unique PO number, specifying what they are buying and the approved amount

- You receive the purchase order confirming they want to proceed

- You complete the work as specified in the PO

- You send an invoice that includes their PO number

- Their accounts payable matches your invoice to the original PO and processes payment

The PO number ties all these steps together, creating an auditable trail from approval to payment.

PO Number vs Invoice Number: What Is the Difference?

Many small business owners confuse PO numbers with invoice numbers. Here is a clear comparison:

| Aspect | PO Number | Invoice Number |

|---|---|---|

| Issued by | Buyer (your client) | Seller (you) |

| Purpose | Authorizes a purchase | Requests payment |

| Timing | Before work begins | After work is completed |

| Who creates it | Client’s purchasing department | Your invoicing system |

| Function | Pre-approval mechanism | Payment trigger |

Key distinction: The PO number comes from your client and authorizes spending. The invoice number comes from you and requests payment. Both numbers should appear on your invoice to connect authorization with the payment request.

Why Do Companies Require PO Numbers on Invoices?

Large organizations use purchase orders for several practical reasons that directly affect how quickly you get paid:

Budget Control and Spend Management

Purchase orders create a paper trail that prevents unauthorized spending. Before any money goes out, someone with authority must approve the expense and assign it to the correct budget category. This protects both the company and you by ensuring funds are allocated before work begins.

Audit Compliance and Documentation

For publicly traded companies, government agencies, and regulated industries, purchase orders provide documentation that auditors require. They demonstrate that proper approval processes were followed for every expenditure.

Accounts Payable Efficiency

When a company processes hundreds or thousands of invoices monthly, PO numbers allow accounts payable staff to quickly verify and route payments. Without a PO number, your invoice may sit in a queue waiting for manual investigation.

Three-Way Matching Process

Many organizations use three-way matching to verify invoices before payment. This process compares:

- The purchase order (what was authorized)

- The receiving report (what was delivered)

- Your invoice (what you are billing)

If all three documents match, payment is approved. The PO number is essential for this verification process to work.

Dispute Prevention

If questions arise about what was ordered, when, or for how much, the original purchase order serves as the authoritative record both parties agreed to. This protects you as much as it protects your client.

How to Get a PO Number from Your Client

If you are new to working with corporate clients, you might wonder how to obtain a PO number in the first place. Here are the common scenarios:

The Client Provides It Proactively

Many corporate clients automatically send you a purchase order after accepting your quote. This is the easiest scenario. Save the PO number and reference it on your invoice.

You Need to Request One

Sometimes clients assume you know their process. If you have completed work without receiving a PO, contact your point of contact and ask directly:

“Before I send the invoice, does your company require a purchase order number? If so, could you provide the PO so I can include it on the invoice?”

Smaller Projects May Not Require One

Some companies only require POs for purchases above a certain threshold, often between $500 and $5,000. For smaller jobs, they may process invoices without one. Ask about their policy upfront to avoid confusion later.

Government and Enterprise Clients

Government agencies and large enterprises almost always require PO numbers. For these clients, never begin work without a confirmed purchase order in hand.

How to Add a PO Number to Your Invoice

Adding a PO number to your invoice is straightforward, but placement matters for fast processing. Here is where it should appear:

Optimal Placement

Position the PO number near the top of the invoice, typically in the header section alongside other reference information. The PO number should be clearly labeled and easy to find at a glance.

A well-structured invoice header should include:

- Your invoice number

- Invoice date

- Payment due date

- Client’s PO number (prominently displayed)

- Project or job description

Why Visibility Matters

Accounts payable staff often process invoices quickly. If they cannot find the PO number within seconds, your invoice may get set aside, returned, or delayed in a queue waiting for clarification.

Field Service Tip

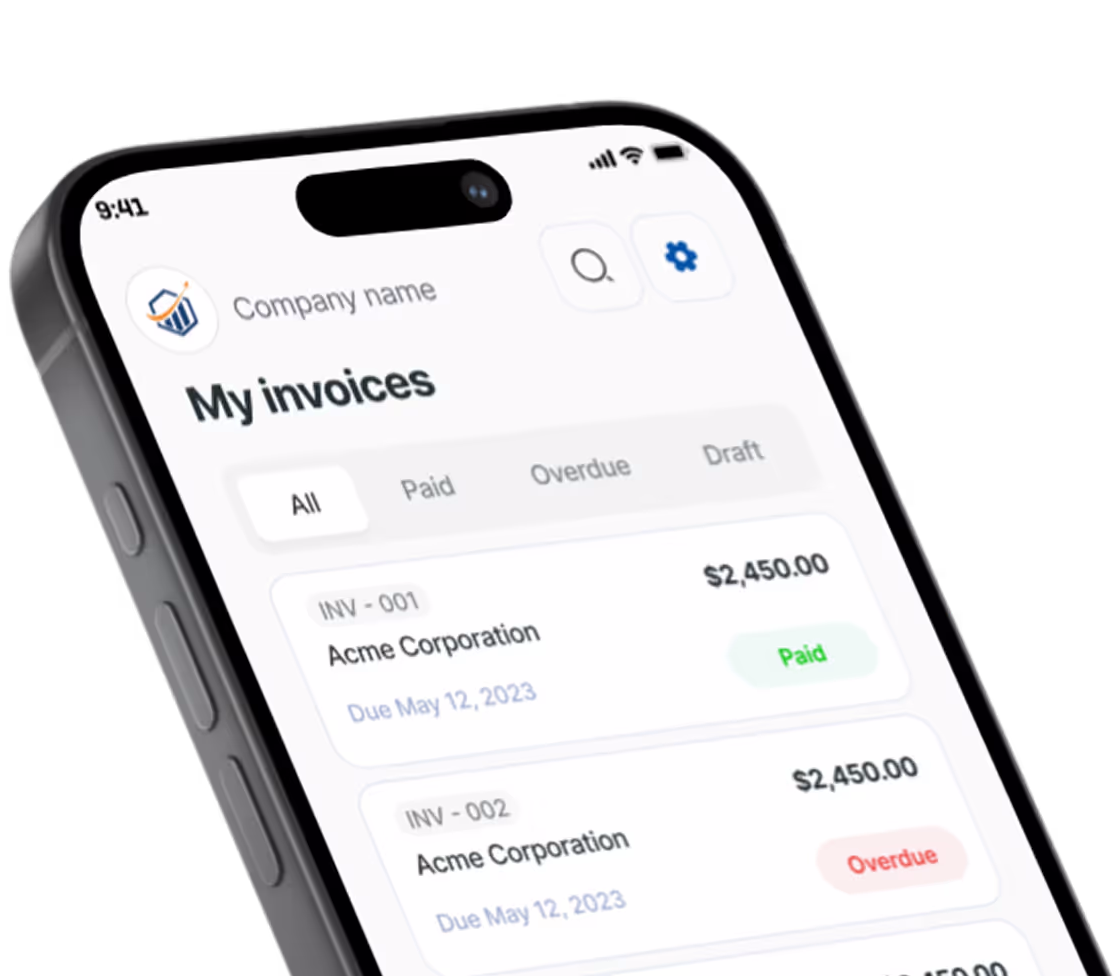

For field service professionals who receive PO numbers on job sites, mobile invoicing tools prove invaluable. Rather than scribbling the PO number on paper and hoping it gets transcribed correctly later, you can enter the PO number directly into your invoice app. Pronto Invoice includes a dedicated PO number field that keeps this critical information visible and properly formatted, which means fewer rejected invoices and faster payments.

Common PO-Related Payment Delays (And How to Avoid Them)

Understanding the typical problems that cause payment delays helps you prevent them:

Missing or Incorrect PO Number

The Problem: You submit an invoice without a PO number, or with a typo in the number. The invoice gets rejected or sits in a queue waiting for clarification.

The Solution: Always confirm you have the correct PO number before invoicing. Double-check the number against the original purchase order document. If invoicing from a mobile device, verify the number immediately after entering it.

Invoice Amount Exceeds PO Amount

The Problem: The purchase order authorized $5,000, but your invoice is for $5,500. Even if the extra work was legitimate, accounts payable cannot process an invoice that exceeds the approved amount.

The Solution: If scope changes during a project, request a revised PO or a supplemental PO before completing the additional work. Never assume the client will simply pay more than the PO authorizes.

PO Has Expired

The Problem: Some purchase orders include expiration dates. If you invoice after that date, payment may be denied.

The Solution: Check PO terms carefully and complete work within the specified timeframe. If delays occur, request a PO extension in writing before the expiration date.

Invoice Sent to Wrong Department

The Problem: You email the invoice to your project contact, but invoices need to go directly to accounts payable.

The Solution: Ask upfront where invoices should be sent. Many companies have specific email addresses or portals for invoice submission. Include the PO number in the email subject line for faster routing.

Goods or Services Not Confirmed as Received

The Problem: The company requires confirmation that they received what was ordered before processing payment. If nobody confirms receipt, your invoice waits.

The Solution: Ensure your point of contact knows to confirm receipt or completion with their internal team. Some companies require you to obtain a signed delivery receipt or completion acknowledgment.

PO Invoices vs Non-PO Invoices: When Each Applies

Not every invoice requires a purchase order. Understanding the difference helps you adapt to different client requirements:

PO Invoices

A PO invoice references a purchase order number and is tied to pre-approved spending. These are standard for:

- Corporate clients with formal procurement processes

- Government agencies and public sector organizations

- Large enterprise accounts

- Projects above spending thresholds

Non-PO Invoices

A non-PO invoice (also called an expense invoice) does not have a corresponding purchase order. These typically apply to:

- Small purchases below the client’s PO threshold

- Emergency or urgent purchases

- Recurring subscriptions or utilities

- Small business clients without formal procurement

Non-PO invoices often require additional approval steps and may take longer to process. When possible, request a PO even for smaller projects to streamline payment.

Best Practices for Small Businesses Working with Purchase Orders

Adopt these habits when working with corporate or government clients:

Ask about PO requirements during the quoting process. Do not wait until invoicing to discover their policies.

Keep a copy of every purchase order you receive. Store them digitally where you can reference them quickly when creating invoices.

Match your invoice line items to the PO. If the PO lists “HVAC system maintenance,” your invoice should use similar language, not a vague “services rendered.” Proper invoice formatting ensures your line items are clear and match the PO description.

Invoice promptly after completing work. Delays on your end can push you past PO expiration dates or budget cycles. Understanding what the invoice date means helps you appreciate why timing matters.

Follow up professionally if payment is late. Reference both your invoice number and their PO number in any payment inquiries.

Track PO numbers systematically. Use invoicing software with dedicated PO fields rather than awkwardly fitting this information into notes sections.

Simplify PO Tracking with the Right Invoicing Tools

Managing PO numbers becomes second nature once you have a proper system. If you frequently work with corporate clients, look for invoicing software that:

- Includes a dedicated PO number field prominently on invoices

- Allows you to search past invoices by PO number

- Stores PO information for easy reference during payment follow-ups

- Works on mobile devices for capturing PO numbers on job sites

Mobile invoicing is particularly valuable for field service professionals who receive PO numbers in the field. Being able to enter the PO number directly into your phone while standing with the client eliminates transcription errors and forgotten numbers. Pronto Invoice was built with exactly this workflow in mind, making it simple to capture PO information on-site and generate professional invoices before you leave the job.

Frequently Asked Questions About PO Numbers

What does PO number mean on an invoice?

A PO number (purchase order number) on an invoice is a unique reference code provided by your client that links your invoice to their pre-approved purchase authorization. It allows their accounts payable department to verify the purchase was approved and match your invoice to their internal records.

Who provides the PO number - the buyer or seller?

The buyer (your client) provides the PO number. They generate it when they create a purchase order to authorize spending. As the seller, you include their PO number on your invoice so they can match it to the original authorization.

Is a PO number the same as an invoice number?

No. A PO number is issued by the buyer to authorize a purchase, while an invoice number is issued by the seller to request payment. Both numbers should appear on a properly formatted invoice.

What comes first - a PO or an invoice?

The purchase order always comes first. It authorizes the purchase before work begins. The invoice comes after you complete the work, requesting payment for what was delivered.

Do all businesses require PO numbers?

No. PO requirements are most common with corporate clients, government agencies, and larger organizations. Small businesses and individual clients typically do not use formal purchase order systems.

Can I invoice without a PO number?

It depends on the client. Some organizations will not process any invoice without a valid PO number. Others have thresholds below which POs are not required. Always ask about your client’s policy before invoicing.

What happens if I use the wrong PO number?

Your invoice will likely be rejected or delayed. The accounts payable team cannot match it to an approved purchase, so it will sit in a queue or be returned to you for correction. Always double-check PO numbers before submitting invoices.

Conclusion

A PO number is simply a tracking code that connects your invoice to your client’s internal approval process. While purchase orders add a step to your invoicing workflow, they actually protect both you and your client by ensuring everyone agrees on the scope and cost before work begins.

By understanding how PO numbers work, requesting them proactively, and including them correctly on your invoices, you avoid the payment delays that frustrate many small businesses working with larger organizations. Treat purchase order numbers as a normal part of professional B2B transactions, and they become an asset rather than an obstacle to getting paid.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.