Consulting Invoice Template

Create professional consulting invoices in minutes. Download free templates or use our app to track hours, projects, and retainers.

Download Free Consulting Invoice Template

Get Your Free Consulting Invoice Template

Download in your preferred format. Customize with your logo, colors, and business details. Start invoicing professionally in minutes.

Microsoft Word

Easy to customize, add your logo

Microsoft Excel

Auto-calculate totals and taxes

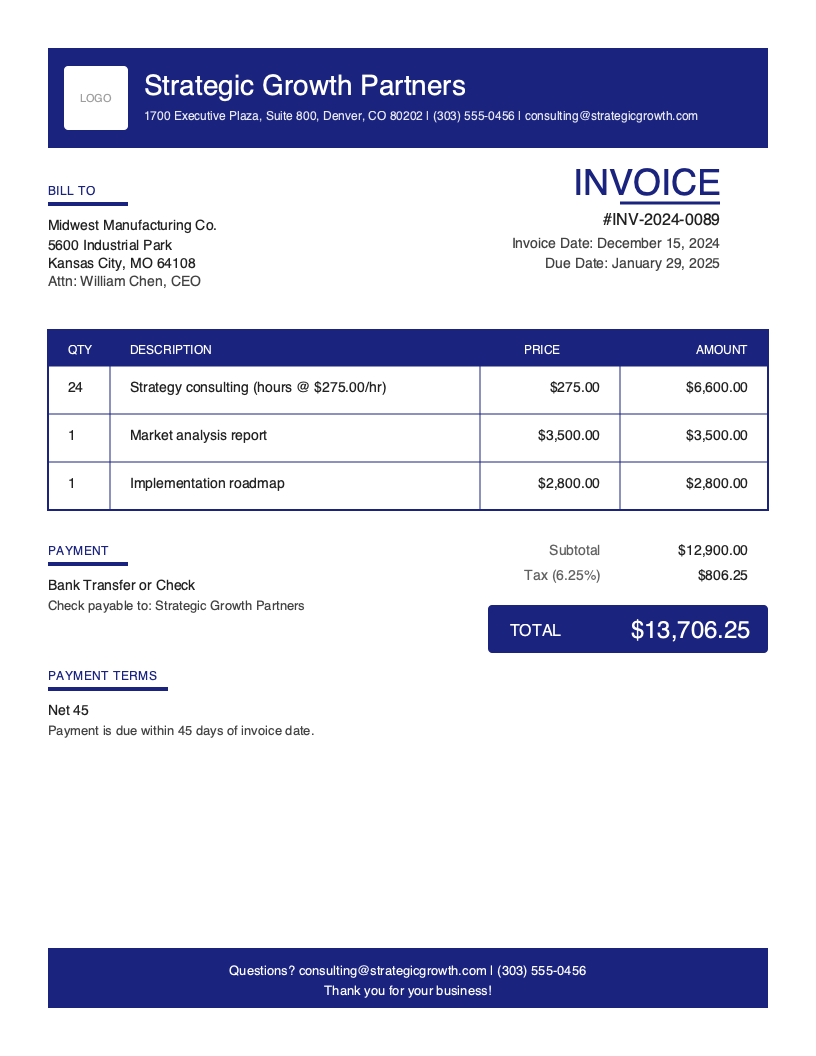

Consulting Invoice Template Variations

Choose from multiple professional designs. Customize colors, add your logo, and make it yours.

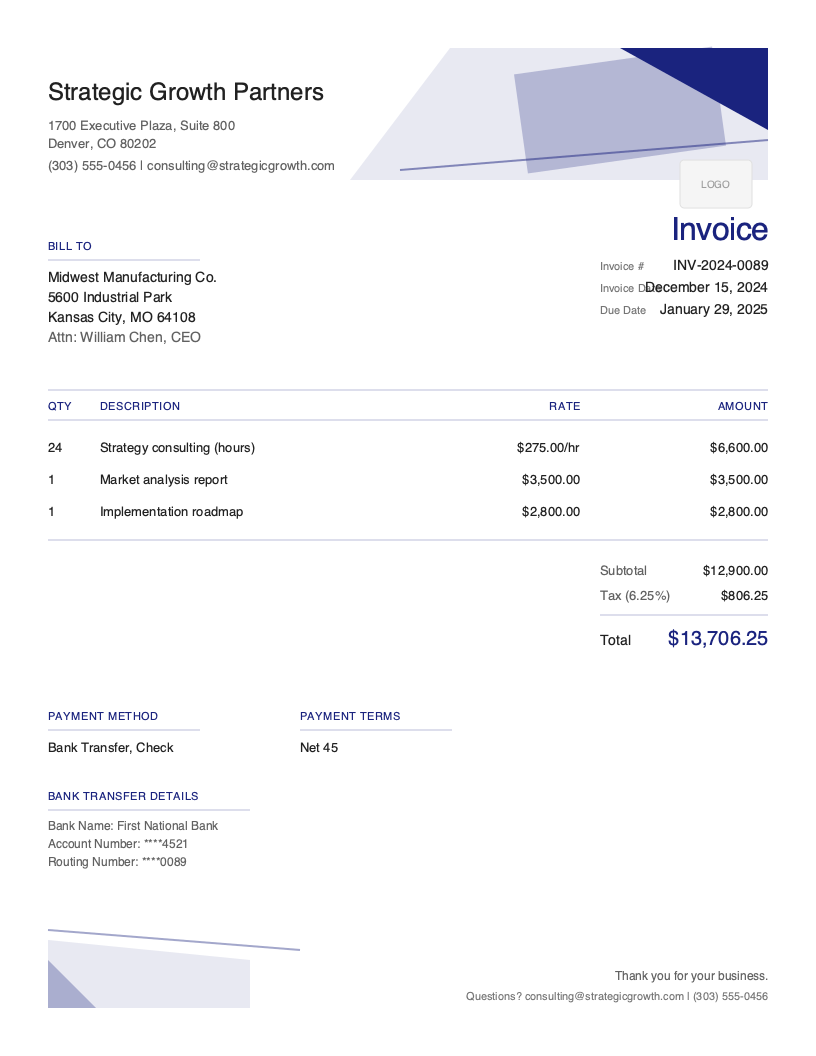

Artistic

Creative accent design

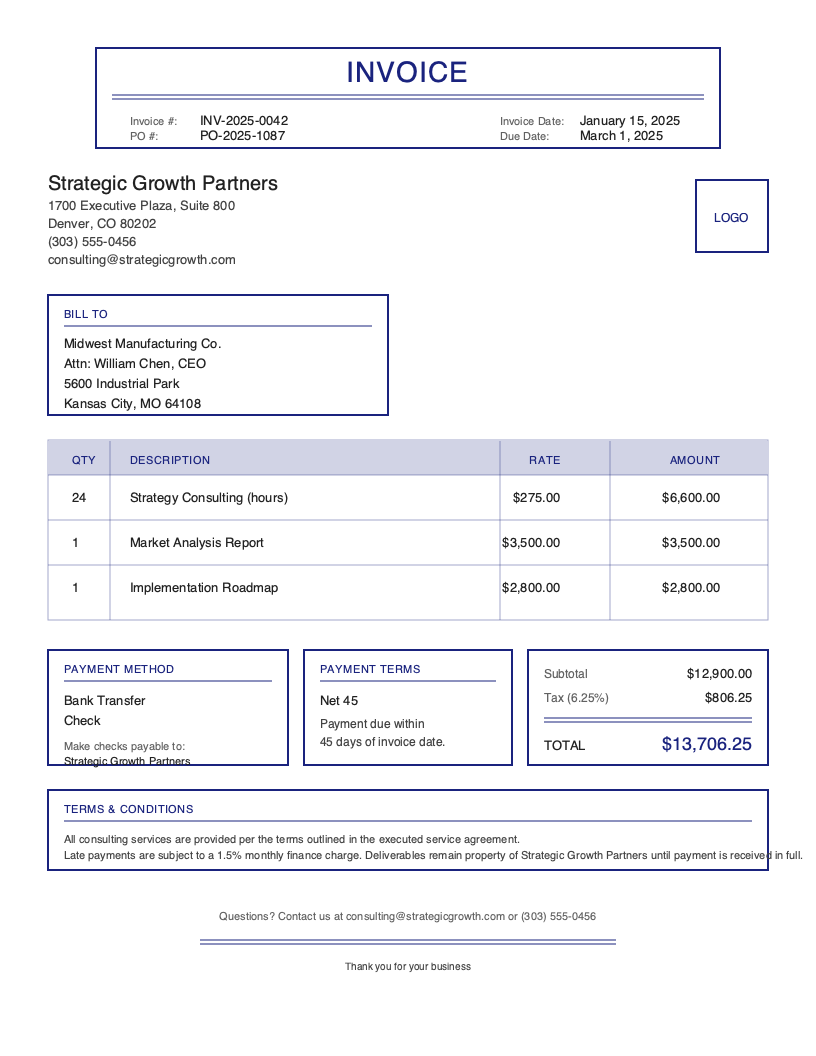

Classic

Traditional professional look

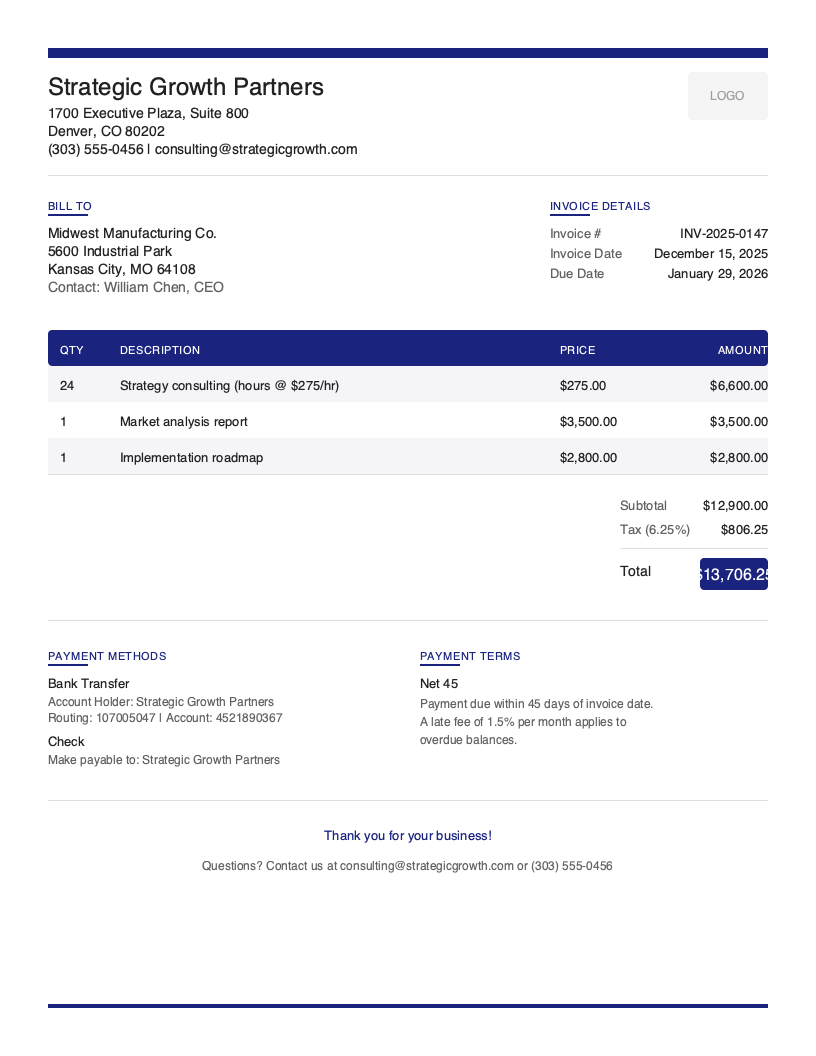

Modern

Clean contemporary style

No signup required. Create and download instantly.

Your expertise is valuable—your invoicing should reflect that. Whether you’re a management consultant billing Fortune 500 clients or an independent advisor working with small businesses, professional invoices reinforce your credibility and ensure you get paid what you’re worth.

Consulting engagements involve unique billing complexities: hourly versus project-based fees, retainer arrangements, milestone payments, and expense reimbursements. A vague invoice that simply says “consulting services” invites questions, delays payment, and undermines the value perception you’ve worked hard to establish.

We’ve created free consulting invoice templates and this comprehensive guide to help consultants bill professionally and get paid faster. From solo practitioners to boutique firms, this page covers everything you need to know about consulting invoices.

What You’ll Find on This Page

- Free downloadable consulting invoice templates (PDF, Word, Excel, Google Docs)

- Essential fields every consulting invoice needs

- Billing best practices for different engagement types

- How to create professional invoices that reinforce your expertise

Download Free Consulting Invoice Templates

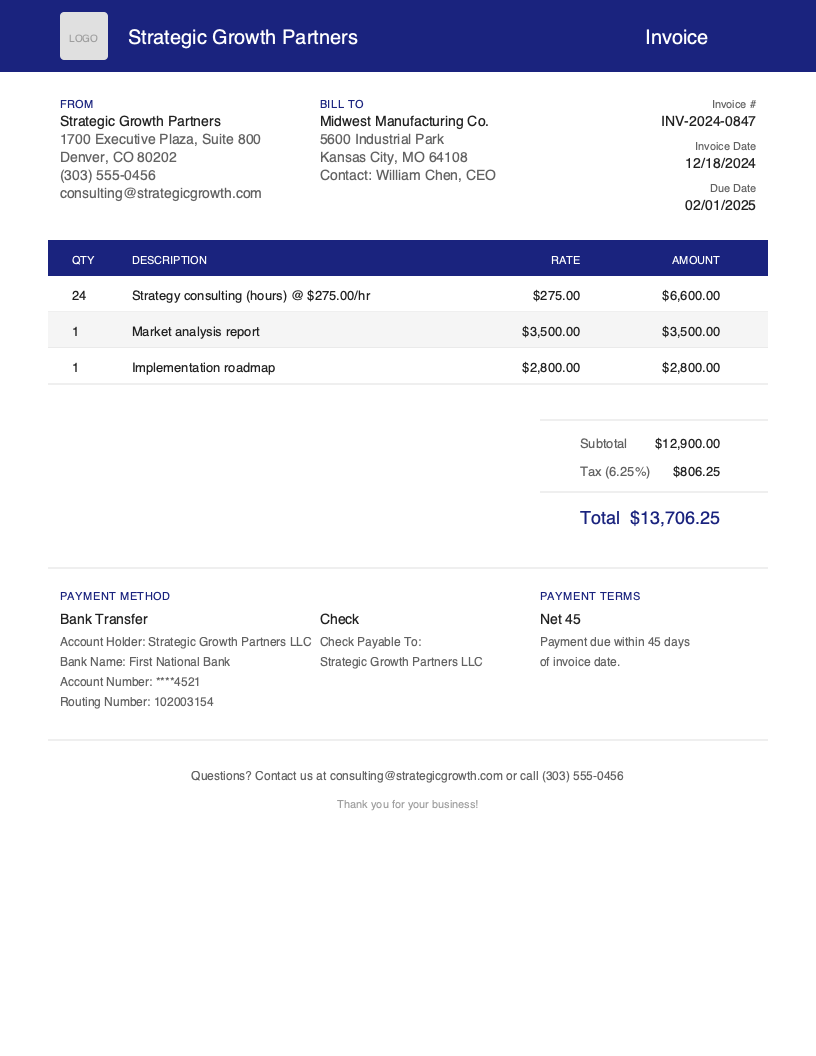

Get started immediately with our professionally designed consulting invoice templates. Choose your preferred format—for hourly billing, Excel and Google Sheets templates include formulas that automatically calculate totals from your hours and rates. For project-based billing, Word and Google Docs offer more flexibility for detailed deliverable descriptions.

What to Include in a Consulting Invoice

Consulting invoices differ significantly from product or service invoices. Your clients are paying for expertise and outcomes, not physical goods or standardized services. Your invoice should clearly communicate the value delivered while providing the documentation clients need for their records and approvals.

Consulting-Specific Fields to Include

Project/Engagement Reference - Every consulting invoice should clearly reference the specific project, engagement, or statement of work (SOW) being billed. Include the project name, SOW number, or contract reference. Many corporate clients require PO numbers—include these prominently if provided.

Billing Period - Unlike product invoices with a single transaction date, consulting invoices cover work performed over a period. Clearly state the billing period (e.g., “Services rendered: November 1-30, 2024”).

Service Descriptions - Consulting services require more detailed descriptions than “hours worked.” Describe the activities performed and value delivered: “Strategic planning workshop facilitation (8 hours)” or “Market analysis and competitive assessment—Phase 2 deliverable.”

Expense Reimbursements - Many consulting engagements include expense reimbursement for travel, materials, or third-party services. Create a separate section for expenses, distinct from professional fees.

Retainer Application - For retainer arrangements, show how the current invoice applies to the retainer balance. Document the original retainer amount, previous usage, current charges, and remaining balance.

Understanding Consulting Business Invoicing

The global consulting market exceeds $300 billion annually, with the U.S. market representing approximately $80 billion. Independent consultants and boutique firms represent a growing segment, with over 700,000 consultants operating independently in the United States alone.

Your invoice is a final touchpoint that shapes client perception. A poorly formatted invoice with vague descriptions undermines the expertise and professionalism you’ve demonstrated throughout the engagement. Conversely, a polished, detailed invoice reinforces your value and professionalism.

The typical consulting invoice takes 45-60 days to collect from corporate clients. Clear payment terms, multiple payment options, and consistent invoicing practices significantly reduce collection time.

Consulting Invoicing Best Practices

Invoice Promptly and Consistently

Establish a regular invoicing schedule and stick to it. For ongoing engagements, invoice on the same day each month—clients will expect and budget for it. For project work, invoice immediately upon milestone completion while the delivered value is fresh.

Match Invoice Detail to Client Requirements

Some clients want minimal detail—a single line item with total fees. Others require exhaustive time logs, activity descriptions, and expense documentation. Ask during engagement kickoff: “What level of detail does your accounting team need on invoices?”

Describe Value, Not Just Activities

Move beyond “consulting services—40 hours” or “strategy work.” Describe what you did AND the business value delivered: “Facilitated executive alignment workshop resulting in approved 3-year technology roadmap” or “Conducted customer research interviews (12) and delivered insights report with 15 actionable recommendations.”

Separate Fees from Expenses

Never bury expenses within professional fees. Create distinct sections for consulting fees and expense reimbursements. This transparency satisfies client accounting requirements and prevents questions about inflated fees.

Reference Agreements and POs

Corporate clients require purchase order numbers for invoice processing. Include PO numbers prominently—invoices without POs often sit in approval limbo for weeks. Reference your engagement letter, SOW, or master service agreement.

Offer Convenient Payment Options

While wire transfers and ACH remain standard for larger consulting invoices, offering credit card payment for invoices under $10,000 can dramatically accelerate collection. Make payment as easy as possible.

Track Time Accurately Throughout Engagements

For hourly billing, accurate contemporaneous time tracking is essential. Don’t reconstruct hours at month-end—you’ll undercount (leaving money on the table) or overcount (inviting client pushback).

Create Consulting Invoices in Under 60 Seconds

Your time is valuable—don’t waste it on administrative tasks. Pronto Invoice helps consultants create professional invoices quickly so you can focus on client work.

Project and Client Organization - Organize invoices by client and project. Quickly access engagement history, track retainer balances, and maintain clean records.

Consulting-Specific Features - Hourly time tracking with rate calculations, project-based milestone invoicing, retainer tracking and balance management, expense reimbursement categorization, and multiple rate support for team billing.

Professional Presentation - Choose from clean, professional templates that reflect the quality of your work. Add your logo, customize colors, and include credentials or certifications.

Get Paid Faster - Accept credit cards, ACH transfers, and wire payments directly from your invoice. Clients can pay with one click—reducing friction means faster payment.

Consulting Invoicing Best Practices

Invoice Promptly and Consistently

Establish a regular invoicing schedule and stick to it. For ongoing engagements, invoice on the same day each month.

Describe Value, Not Just Activities

Move beyond 'consulting services—40 hours.' Describe what you did AND the business value delivered.

Separate Fees from Expenses

Never bury expenses within professional fees. Create distinct sections for consulting fees and expense reimbursements.

Reference Agreements and POs

Corporate clients require purchase order numbers for invoice processing. Include PO numbers prominently.

Track Time Accurately

For hourly billing, accurate contemporaneous time tracking is essential. Don't reconstruct hours at month-end.

Frequently Asked Questions

A professional consulting invoice should include your business information and credentials, client name and billing contact, invoice number and date, project or engagement reference, billing period, detailed description of services rendered, hours worked (if applicable), consulting fees, expense reimbursements, payment terms, and payment instructions.

Consultants use several billing models: hourly billing for advisory work, project-based fees for defined deliverables, retainer arrangements for ongoing access, and value-based billing tied to business outcomes. Many consultants combine models based on the engagement.

Net 30 is standard for most consulting engagements. Large enterprises may request Net 45 or Net 60. For project work, milestone payments upon deliverable completion are common. Some consultants require deposits (25-50%) before starting work.

Related Invoice Templates

Start Creating Professional Consulting Invoices Today

Join thousands of professionals who use Pronto Invoice to get paid faster. Create your first invoice in under 60 seconds.

This guide is for informational purposes only and does not constitute legal or tax advice.